Text: Thomas Masuch

Reading time: 6 minutes

Takeaway 6: Large-format 3D printing is booming

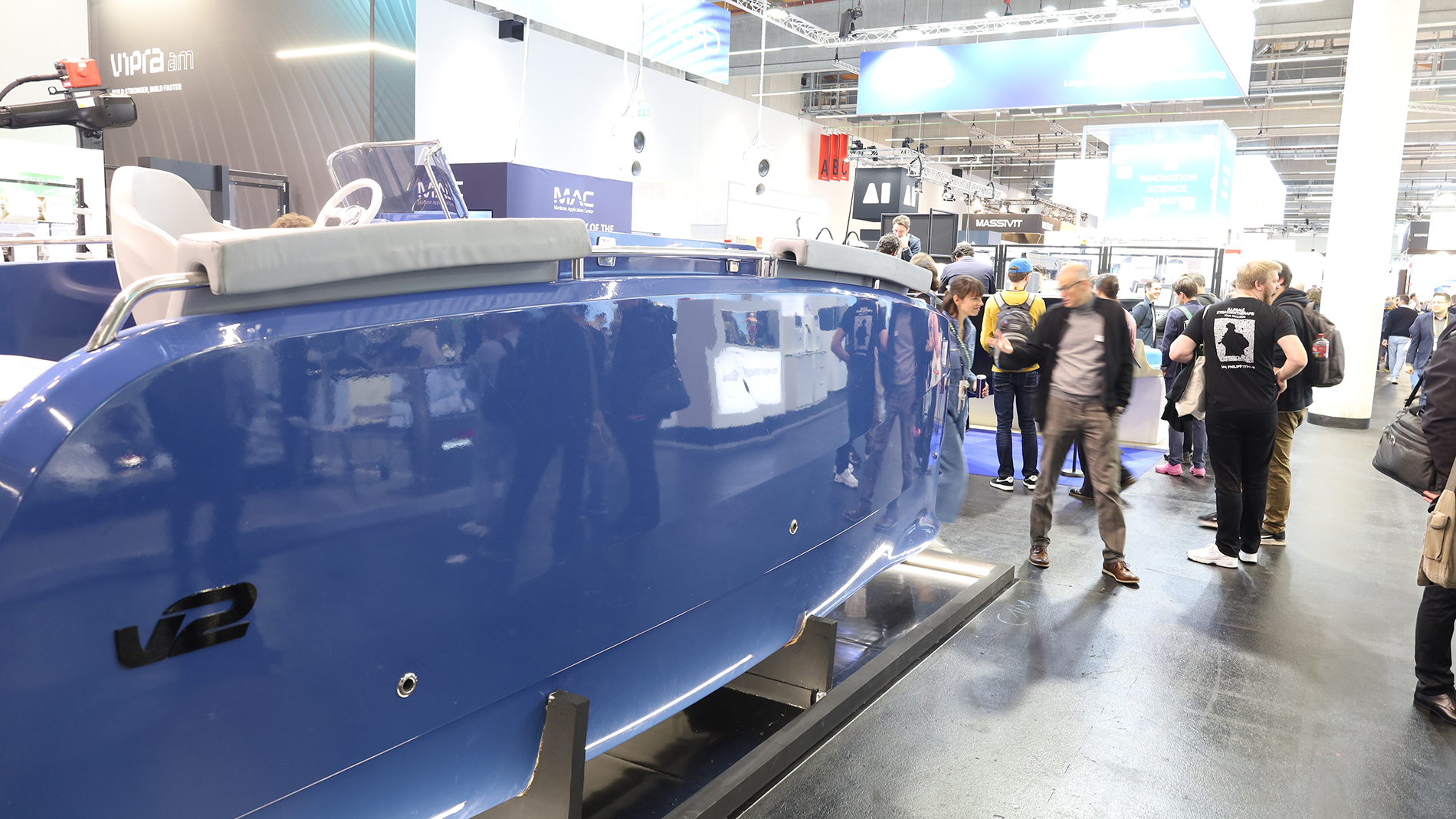

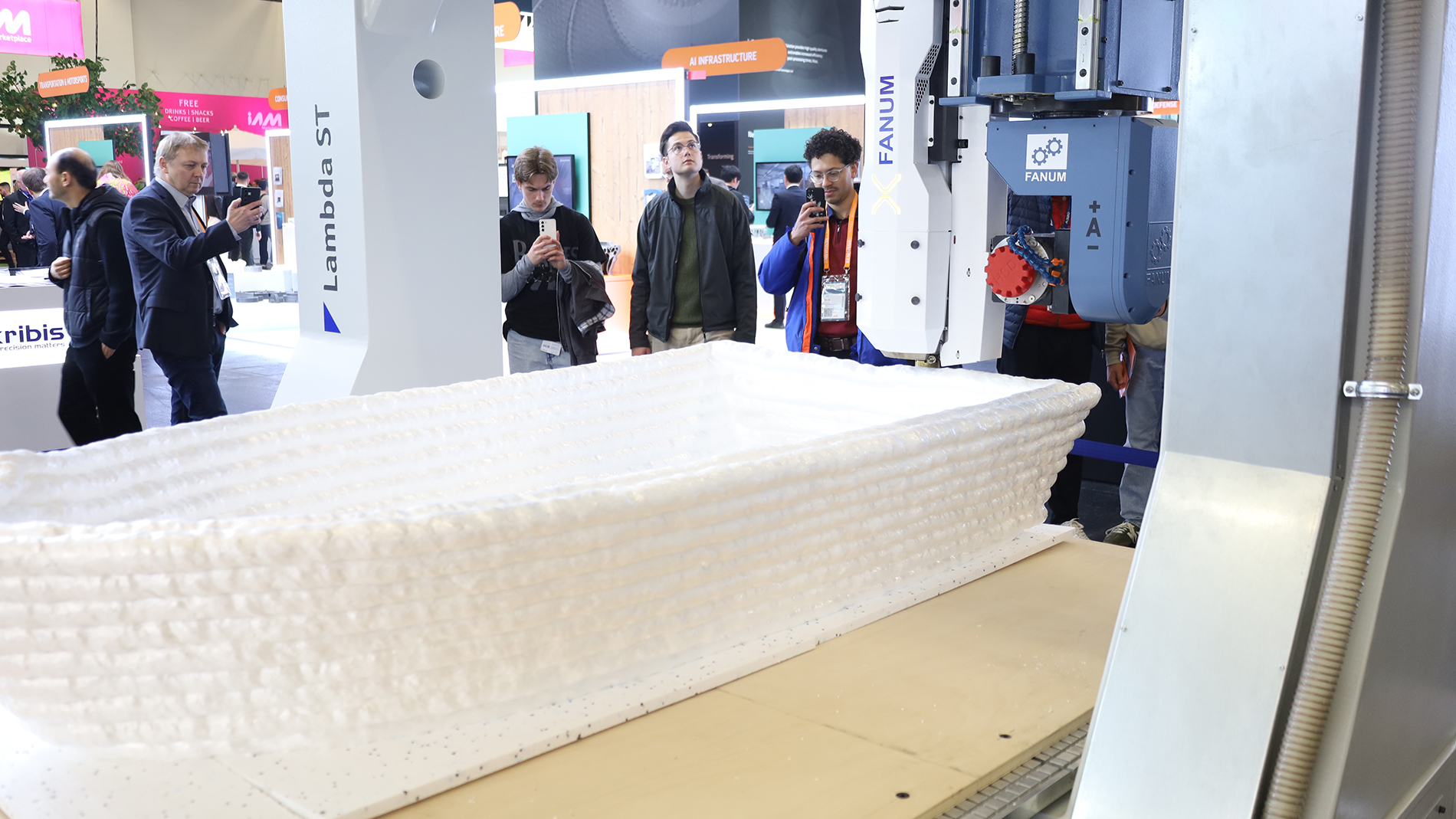

One of the visual highlights of Formnext 2025 featured the components spanning several meters that were on display at the booths of CEAD, Caracol, CMS, Rapid Fusion, Yizumi, and other providers of LFAM (large-format Additive Manufacturing) technology. The exhibits even included luxury boats, some of which were converted into a kind of meeting room. The Polish company Fanum also printed boat hulls from polystyrene and stacked up several prototypes at its booth over four days of the trade fair, forcing it to pause its hybrid gantry system because there would not have been enough space otherwise, as CTO Szymon Skorupski explained. Fanum is a good example of the development of this still-young subsector of AM: The medium-sized company actually has its roots in machining, but discovered 3D printing a few years ago. It has already developed a number of applications and is continuing to develop further applications for its technology together with other Formnext visitors.

Meanwhile, LFAM was not only a hit in the polymer sector at Formnext: MX3D, WAAM3D, and Gefertec showcased exciting applications in metal, and Caracol has also successfully entered the metal sector with its Vipra system.

LFAM constantly opens up new possibilities. Images: Thomas Masuch

Takeaway 7: Industry remains highly innovative

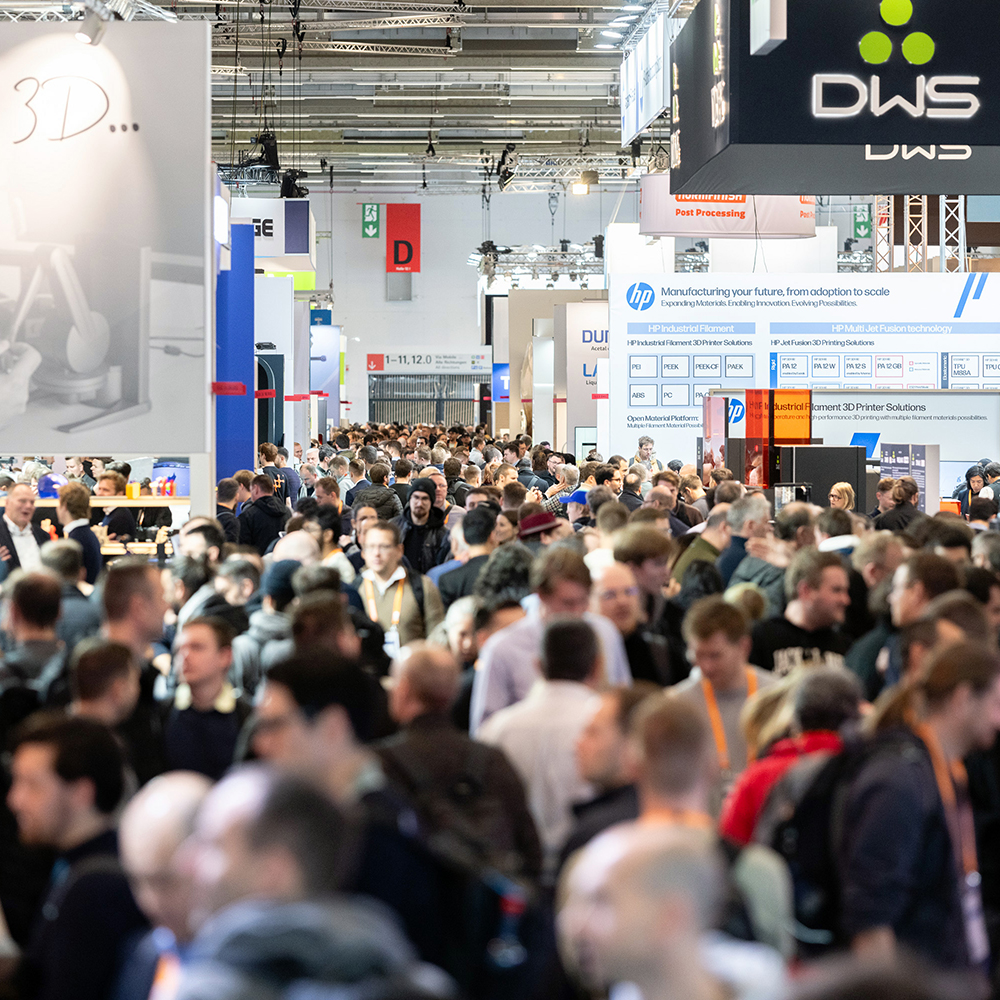

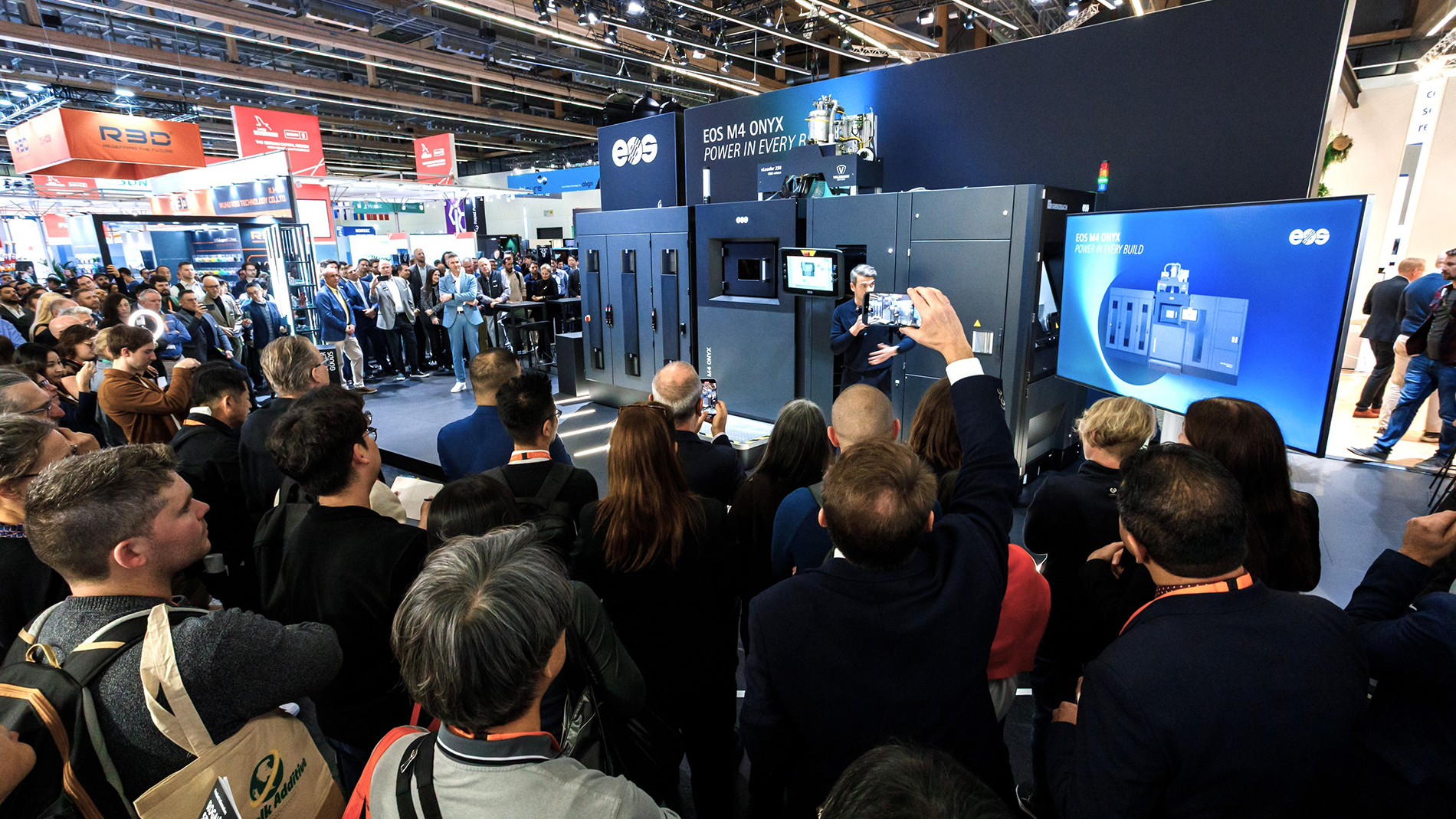

Even though the AM world is focusing even more strongly on specific applications – and ultimately on generating revenue – the industry remains enormously innovative. Proof of this can be seen in the plethora of product launches, with the premieres of the H2C Bambu Lab and the EOS M4 Onyx certainly attracting the most attention in 2025. While Bambu Lab combines “engineering precision” with its new multi-material printer, EOS promises significantly higher productivity, reliability, and cost efficiency with its new system, the successor to the EOS M400-4. In addition, there were numerous other new systems, materials, software, and post-processing solutions, as well as new AM marketplaces. (We already published a wide selection in our preview of Formnext 2025.) In addition, numerous equipment manufacturers presented updates to their existing machines. Overall, it became clear that many of the innovations were developed for very specific applications and market segments in which they offer real added value. Another factor was the further increase in efficiency, which has been achieved not only in new machines, but also by solutions that improve the entire workflow.

Takeaway 8: Asia establishes itself in Europe’s competitive arena

Asian AM companies have staked out positions as important players in many segments of the Additive Manufacturing industry. In addition to their technologically advanced machines (which are usually available at significantly lower prices), many companies have improved their service in these important markets, including by establishing locations in Europe and the US. While the AM market in Asia is growing rapidly, competitive pressure remains high – particularly in China, which is prompting many Chinese suppliers to focus even more strongly on the West as a sales market. Here, the US customs issue has made Europe increasingly attractive. Conversely, it is difficult for Western suppliers to benefit from growth in Asia. However, Exentis Group AG recently proved that it can still work in Asia: Just two weeks after Formnext, the Swiss specialist in 3D screen-printing technology announced the sale of 10 systems worth around CHF 18 million (around EUR 19.2 million) to a customer in Asia.

Takeaway 9: Aerospace, healthcare, and defense are driving user industries

The 3D-printed components presented at Formnext clearly showed which industries are currently driving the market. Aerospace and healthcare have been among the top three user industries for many years. A large number of booths (both from service providers and suppliers of AM systems, materials, and software) featured components for aircraft and rocket engines in a wide range of sizes, as well as complete drones or parts thereof. One visual highlight in the aviation sector was a complete turboprop engine with numerous additively manufactured components that was showcased at the Colibrium Additive/AP&C booth (the Catalyst engine is being used in the Amber project as a demonstrator for aircraft powered by hydrogen cells). In the medical and healthcare sector, the range of products on offer ranged from aligners and metal dental crowns to various orthoses and prostheses. In the next issue of FON, we will take a closer look at the current situation and opportunities for AM in the latter two areas.

In addition, the defense sector has clearly established itself as an important sales market for AM companies. This was evident in the silencers on display and the aforementioned drones, as well as in solutions for spare parts and repairs in the field. Many companies, especially AM system manufacturers, seem to be responding to a significant increase in demand here.

More information:

Part one including the following trends:

- Takeaway 1: Cautious optimism that the period of disillusionment is over

- Takeaway 2: New phase in the maturation process – a new era for AM?

- Takeaway 3: Consolidation not necessarily a negative development

- Takeaway 4: Industrial applications becoming the benchmark

- Takeaway 5: Affordable FDM desktop printers increasingly used in professional settings