Text and pictures: VoxelMatters, 18 March 2025

VoxelMatters is releasing its new Metal AM 2025 market new report today, showcasing a significantly altered market landscape compared to the previous edition. These changes are evident in the latest list of the Top 10 Metal AM companies for 2024 by overall revenue, which features new entries and notable absences. EOS remains at the top of the list, now followed by BLT and Nikon SLM Solutions. In the previous edition, Nikon SLM Solutions held second place and 3D Systems was third.

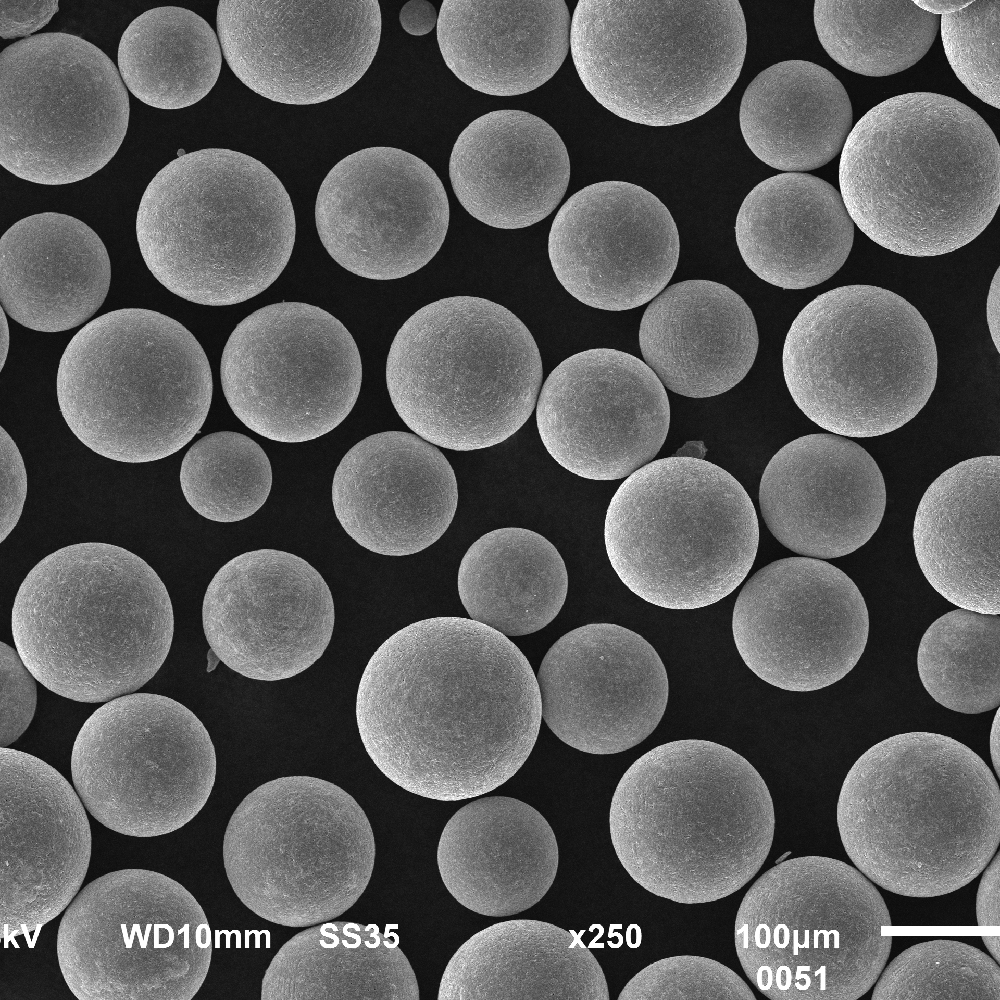

Discover the latest Top 10 Metal AM companies for 2024, featuring new entries and notable changes in ranking. Get insights into the evolving metal AM market landscape. The global metal AM market is valued at $4.7 billion in 2024 (including hardware, materials, and services revenues) and is expected to grow to nearly $60 billion by 2034. Hardware is the leading revenue driver, generating $2.4 billion in 2024, reflecting a 28% year-over-year increase. Materials experienced the fastest growth, reaching $820 million with a 35.6% rise, driven by the increasing demand for high-value metals like titanium. Services also showed steady growth, contributing $1.5 billion to the market with a 16.7% increase.

Top Metal AM performers in 2024

EOS maintains its market leadership by leveraging a consolidated business model, which includes supplying hardware to the specialized subsidiary AMCM, focusing on metal AM hardware and materials. Built over two decades, this leadership remains solid, particularly as the company has expanded its activities into the key US market with locally produced systems. The third-place company, Nikon SLM Solutions, has followed a similar trajectory, achieving significant growth—despite losing a position to BLT—driven primarily by sales of large-format NXG systems, a US-based production facility, and synergies made possible by its parent company, Nikon.

BLT, which has risen from sixth place in the previous edition to second, leads among the Chinese “Big Five” metal AM companies, which include Farsoon, EPlus3D, HBD, and Kings 3D. All these, except for Kings 3D—which is already actively exploring international markets for metal printing after the recent acquisition of LASERADD—are now among the top 10 metal AM companies, with Farsoon in seventh, EPlus3D in ninth, and HBD rounding out the list at number ten. This evident growth is also reflected in the report’s overall data, particularly concerning hardware and services. The main differentiator for BLT compared to its competitors (including Western ones) is that it is currently the only metal AM company offering a fully integrated solution encompassing hardware, materials, and services.

Leading companies in the top five include 3D Systems and Colibrium Additive (formerly GE Additive), which maintain stable positions. 3D Systems lost a spot to BLT primarily because the previous report included revenues from the company’s services business, which has since been spun off into a separate entity, Quickparts. Today, 3D Systems’ revenues are driven by sales in the dental and industrial sectors through its partnership with GF Machining. Colibrium Additive has remained stable following its rebranding, supported by a solid EBM (Arcam) and materials (AP&C) business, though it faces challenges in the L-PBF sector. The Avio Aero service business is not included here as it is part of GE Aerospace.

Ups and downs in Metal AM

DMG Mori has moved up from eighth to sixth place as the only company that sells both DED and L-PBF systems, with the DED (Lasertec) business driving most of its AM-related revenues. Others, like Nikon SLM Solutions, do so through different divisions of the parent company and are thus accounted for separately. Among the largest players in metal AM hardware, TRUMPF also markets DED and L-PBF; however, the company dropped outside the top 10 positions (from number 9) because its business grew slower than the Chinese competitors.

Among the companies facing significant challenges, Desktop Metal has fallen from fourth to eighth place, experiencing one of the most challenging periods in its relatively short history. Most of the company’s metal AM business comes from the former ExOne hardware, materials, and services sales (acquired in 2021), while all systems developed internally by Desktop Metal—Production, Shop, and Studio—continue to see limited adoption. This analysis does not account for any changes resulting from the announced merger with Nano Dimension and Markforged.

Velo3D has also lost several positions, dropping out of the top 10 metal AM companies list and down from seventh place after a year that severely challenged the company’s continuity. However, it is now rebounding following its acquisition by the relatively unknown company Arrayed Additive, which specializes in aluminum and magnesium materials.

Despite challenges in the broader additive manufacturing (AM) market, numerous promising companies are making significant strides. VoxelMatters has spotlighted the top performers in dedicated charts focused on hardware, materials, and services in its latest Metal AM Market 2025 report. The report compiles company-specific data from over 460 businesses, organizing it into charts categorized by technology, alloys, and part types. With over 150 tables and graphs, it provides a comprehensive overview of everything that transpired in the Metal AM market in 2024, along with projections for the next five and ten years.

Get more information and get access to the Metal AM Market 2025 report.