Text and Pictures: VoxelMatters, 15 December 2025

Before beginning this article, I went back and checked last year’s Formnext end-of-show roundup to see if our impression of this year’s show was consistent with what we saw last year. At the time, we had titled the article “Of death and rebirth.” We can now confirm that the overall impression, like many of the trends highlighted in the article, was in fact correct. After rebirth, it’s time to lay the foundation for the next decade of industry growth.

Ten is a recurring number this year. It’s Formnext’s tenth anniversary edition, the market has grown about 10-fold since the first edition, and the outlook for the next decade is again around 10X. Compared to the first Formnext edition 11 years ago (excluding the digital-only COVID edition), the AM industry has grown tenfold, and today it looks almost completely different from how it did back then. The traditional market leaders have undergone dramatic changes, and some have failed to meet expectations. New market leaders have emerged or are emerging that will shape the AM industry in 10 years. And the market itself will look very different. In polymers, we are seeing the emergence of distributed manufacturing alongside industrialization (of large parts and/or larger batches); in metal, we are seeing early mass production. And some of the biggest news includes some interesting niches like RLP’s silicone and Moi’s LFAM of thermosets.

Here we take a look at some of the main polymer AM trends.

The seeds of a new industry

Ahead of the show, the biggest launches announced were Bambu Lab’s H2C (with Vortek technology) and EOS’s new metal 3D printer (which we now know is called Onyx and is sleek black). Both highlighted two of the most important trends at the show. Let’s take a closer look at the first one.

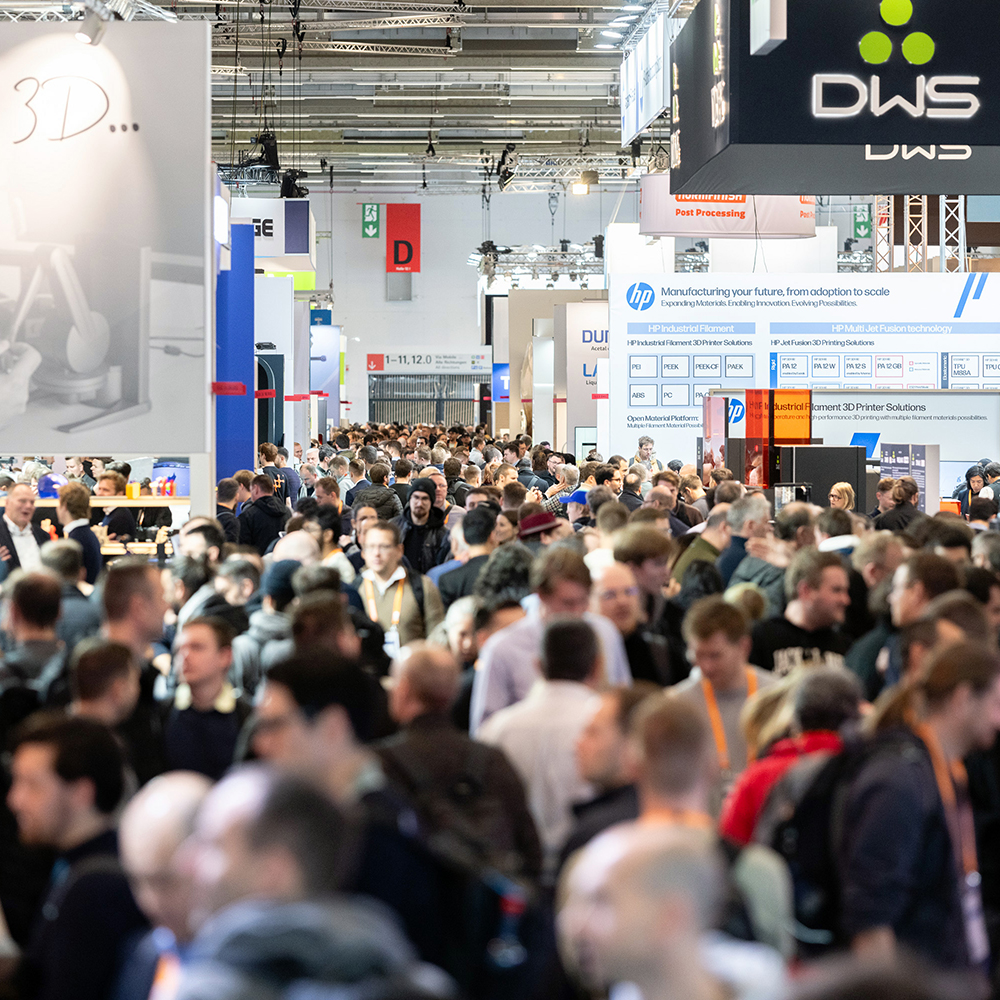

Bambu Lab’s launch was probably the single biggest event ever seen at Formnext in terms of attendance. While Bambu Lab’s 3D printers are seen as consumer machines, the people in attendance at Formnext were not consumers—or at least not just consumers. They were mostly professionals who use multiple Bambu Lab machines for their businesses, ranging from internal industrial use, traditional AM services (prototyping, visual modeling, etc.), to newly invented businesses that were enabled by 3D printing and could not exist cost-effectively before. An example came from our new friends at Cookiedcad… a company that started by making cookie cutters and now makes software and some unique filament.

While from a strictly numerical point of view, the majority of 3D printers sold by Bambu Lab are not going to Formnext attendees, my (unsolicited) suggestion to the executive team at Bambu Lab is to continue consolidating their position within the AM industry through their Formnext participation, taking the sector along for the ride. And enjoy everything that comes with it.

Gone are the days of UltiMaker, Zortrax, and many of the former desktop 3D printing dominators, mainly because they reached for the stars (of the consumer and mass-market businesses) and did not sufficiently cater to their hard core professional audience. Bambu Lab should not make the same error.

This means that Prusa and Creality are the only companies in the desktop filament extrusion segment that can compete today on reach. Creality leverages a strong installed base and an unparalleled range of systems, from modern multimaterial machines to laser cutters and even pellet-based printers from sister brand Piocreat. From market dominator to now a challenger, Creality has the strength to continue competing at a global level, especially targeting professional users and 3D printer farms.

By focusing on Western markets through a new partnership with Siemens and a production facility in the US, Prusa is Bambu Lab’s strongest competitor in the new 3D printing entrepreneur market, offering continuous technological advancements and high-quality products.

While we don’t really believe in the extreme urgency of the company’s “security crusade”, Prusa Research has been able to offer the most credible alternative to Bambu Lab. It can rely on global crowds of dedicated users; however, its communication strategy could use some improvement. For example, we did not hear about the launch of Prusa’s INDX technology until we casually read about it in Josef Prusa’s blog. While the Core ONE system is primarily targeted at consumer users, industrial users also benefit from it. A more effective trade media communication strategy may be beneficial in the future (as was done with the HT90 system).

Together, Bambu Lab, Prusa, and Creality sell millions of machines, driving enormous demand for filament and consumables. Many assumed only major polymer manufacturers could compete in filament production, yet boutique filament companies are claiming healthy market share. Meanwhile, larger companies ranging from first-party providers Bambu Lab and Prusa Research to third-party companies like eSun, Polymaker, SUNLU, Kexcelled and others dominate high-volume production.

In advanced technical materials, both pellets and filaments, Airtech is continuing to build a flourishing business in technical filaments after the Kimya acquisition. New material experts like Xenia Materials have introduced more options in advanced technical materials (we saw some great parts printed with technical composites on Bambu Lab systems). At the same time, most early players have downsized, suggesting the “second mover advantage” (cit. Karsten Heuser) that characterizes many of the most successful companies in AM today.

Overall, something very similar is happening in stereolithography, although the level is generally a bit shifted toward professionals and—at least for now—based on lower overall unit installed base numbers (in the order of several hundreds of thousands rather than millions). Here, Formlabs is the dominant company, with a solid business model and a continuous flow of new high-quality products (and materials) that will enable it to retain that role for the foreseeable future.

The most credible competitors in the professional stereolithography segment are Chinese companies such as HeyGears, which is increasingly emerging as a leader in this field, along with Creality, Elegoo, and Anycubic. Material specialist eSun has also entered this sphere with its new iSun3D line of footwear-specific resins, resin 3D printers and 3D printed products.

The consumer and prosumer resin business is also thriving, which begs the question: Why did BASF, Royal DSM, Covestro, Braskem, Jabil, Mitsubishi, and too many other large material companies pull out of the AM market so quickly? We hope they will regret their decision, but either way, it will take them little to re-enter the market when they see the time is right.

The bottom line is that these new entrepreneurs form the base for the next decade of AM growth. Possible mass-produced products include shoes, eyewear, toys, lighting, furniture elements, design products, mobility accessories, sports equipment, and so much more. It’s still the same products people have been printing for nearly a decade, but now both the quality and the economics are starting to make sense.

Today, these are being printed with (small and large) farms of desktop 3D printers, but tomorrow, many of these will scale to larger systems and more demanding products. When they outgrow the desktop, they’ll have three options:

- Go large size with robotic or gantry-based LFAM

- Go large-batch with high-speed polymer production systems

- Go high-end with advanced material AM

Going large with robots

When the small and medium-sized product market space becomes too limiting, some entrepreneurs will want to start offering large parts and products. Today, the most efficient and cost-effective way to do this is with multi-axis robots, and that’s why some of the most successful and rapidly growing companies in the AM market today operate in this space.

Under the Airtech umbrella, as the segment’s materials leader, and leveraging Ai Build or Adaxis as providers of software to run the robots efficiently and effectively, LFAM companies are thriving. Caracol, CMS, Rapid Fusion, CEAD, and other new and interesting entries like Ginger Additive, are becoming the main go-to option for 3D printing furniture, design elements, as well as a growing number of extra-large applications, such as the full-size commercial catamaran shown by Caracol at its booth.

Ai Build Co-founder Daghan Cam told VoxelMatters that the company is doing well and getting close to profitability, which is a testament to the growth of the robotic LFAM segment as a whole. It will be interesting to see new developments as lower prices AiBuild-powered hardware becomes available, starting with the soon-to-be-released 5-axis 3D printer from Generative Machine, a desktop sub-$5,000 system that could open up interesting new possibilities. The key role of materials and software was reinforced by Airtech’s Director of Additive Manufacturing, Gregory Haye’s talk at the Ai-Build booth.

In terms of hardware, Caracol’s Heron AM platform is emerging as the ideal go-to solution for most LFAM adopters in Western markets. The company presented the in-house-developed Eidos Manufacturing software and partnering with Adaxis (also an Airtech partner) and the AI software company Matta on process optimization software.

At the same time, systems like CMS’s Kreator continues to offer reliable hybrid and gantry-based solutions, along with new players like Rapid Fusion that entered the market more recently. Not all of them were exhibiting at Formnext. Some will be at JEC, the world’s leading composites manufacturing show, next March.

Go large batch with high-speed 3D printing

For those offering 3D printing services with filament extrusion machines and looking to scale their capabilities while introducing more advanced materials, such as nylon, the main solution is HP and powder thermoplastics.

HP, in particular, is carving out a dominant role similar to that played by Bambu Lab in desktop extrusion and Formlabs in desktop stereolithography. With MJF, HP has created a new market made up of service companies with dozens of machines competing with injection molding for larger and larger batches.

The alternative to HP? Right now, other than EOS, which is currently focusing primarily on high-end parts, it consists of low-cost SLS machines like the Fuse1 from Formlabs, with credible new competitors like Raise3D and TPM3D entering the market. These machines could be used on farms (Formlabs and its customers have already demonstrated some examples) to achieve mass production at relatively low cost. This is not yet a consolidated segment, as evidenced by the challenges faced by pioneers such as Sintratec and Sinterit, but new price pressure from Asian SLS companies may help it get scale.

For those who already offer services with Formlabs machines and want to scale to even higher productivity or larger builds, the main solutions available today are provided by Axtra 3D and Carbon. Axtra is growing most rapidly, but Carbon is currently more established, even though the company recently reported some layoffs. Michele Monti, from Italian Carbon-partner AM Service Juno, told us the changes are physiological and will reposition the company for a new growth phase. The traditional resin AM market leaders, 3D Systems and Stratasys, are also competing in this segment, but they seem to remain a step behind (even though they generally report that this area of their business is among their healthiest).

What about SLA? Industrial SLA is a relatively standalone market targeting industrial tools, molds, and patterns for investment casting. Prosumer-level desktop systems do not directly threaten it, but the traditional market leader, 3D Systems, is under siege by UnionTech and a plethora of Chinese companies. Even Stratasys is playing a relevant role in this segment.

UnionTech itself, arguably the largest SLA company in the world today if we consider its fully integrated offer (hardware, materials, and services) is facing tough competition from many other Chinese competitors on the domestic market. This is why UnionTech is trying very hard—but not necessarily succeeding—in entering other markets, both geographically (in the West) and technologically (with metal 3D printing). Either way, this is a market that is fairly consolidated and will continue to grow at a relatively slower but stable pace.

Go high-end with advanced material printing

Another direction for growth is to print with high-end materials that standard desktop systems cannot process. This seems to be a rapidly growing sector, although there are complexities that need to be addressed.

The consensus until now is that while systems like those from Bambu Lab, Prusa, and Creality are creating a huge user base for low-end materials like PLA and PETG, once the requirements get higher and higher—from nylon and PC up to ULTEM, PEEK or PEKK—then Stratasys offers the only truly qualified option for producing large and complex parts using certified materials.

As we mention Stratasys and its core FDM business, it’s also worth noting that the company launched one of the most high profile initiatives of this edition, the iAM Marketplace. This should be seen as an effort to combine all of its product lines while also offering many other powerful material and hardware brands (including Axtra3D, Carbon and HP), all under a single roof. If strength really is in unity, than this initiative could help accelerate the entire polymer AM industry and Stratasys retain its leadership role.

For the high-performance filament extrusion hardware market in particular, over the years, companies like Roboze and INTAMSYS began to expand in this space, with INTAMSYS introducing a new machine for PEEK at this show and Roboze surprisingly absent. One of the biggest surprise news stories from this Formnext is that HP has entered the segment with its own machine (according to reports it is the relaunch of a relatively standard product, but supported by the extensive capabilities of HP’s R&D). BigRep has also introduced high-end materials for its enclosed systems, and others are following suit. Will this challenge Stratasys’ dominance? That remains to be seen, but the growing availability of high-temperature-capable systems suggests a market opportunity exists.

As mentioned earlier, a market for high-end solutions also exists for powder-based SLS. This is in fact AM’s biggest market today and will remain a major segment in the future although, much like industrial SLA, it is a more consolidated segment that is experiencing more linear growth. These applications, found in medical, aerospace, defense, energy and motorsports are based mainly on filled CFR or GFR nylons, and some limited PEKK and PEKK composites. In this area, EOS is challenged only by Farsoon, with HP focusing primarily on neat nylon and TPU. Most Chinese SLS companies are fighting it out mostly in the domestic market and are not yet offering high-end materials proficiently.

Make sure to read the other two parts of our Formnext 2025 trends review: Reinforcing the foundations for the next decade of growth in metal AM and Expanding the foundations for the next decade of AM growth at Formnext.