Text and pictures: VoxelMatters

What a show. Formnext Asia Shenzhen 2025 was truly exciting. Everyone we spoke with was enthusiastic, and I doubt even the organizers could have anticipated such a positive turnout.

“Mission completed!” said Formnext Director Sascha Wenzler. “After a wonderful Formnext Asia Shenzhen 2025 […] next up, Formnext in Frankfurt.” He has good reasons to be satisfied: the show hosted 265 exhibitors and welcomed 20,715 unique visitors (for a total of 27,183 visits), including 733 from overseas. That represents an impressive 78% increase compared to the previous edition. Additionally, the event’s organization was impeccable.

Within a few hours, the halls were buzzing, every conference was packed, and booths were always crowded. That’s exactly what an additive manufacturing show should look like — reminiscent of the early days of Formnext in Frankfurt, when Mesago first set the stage for a decade of booming growth.

From scaling up to breaking limits

The same thing may now be happening in China, and the benefits will ripple throughout the entire AM world. We believe that the significant investments Chinese companies are making — scaling up capabilities, identifying new applications, and launching new products — will accelerate global adoption of AM, benefiting Western companies as well.

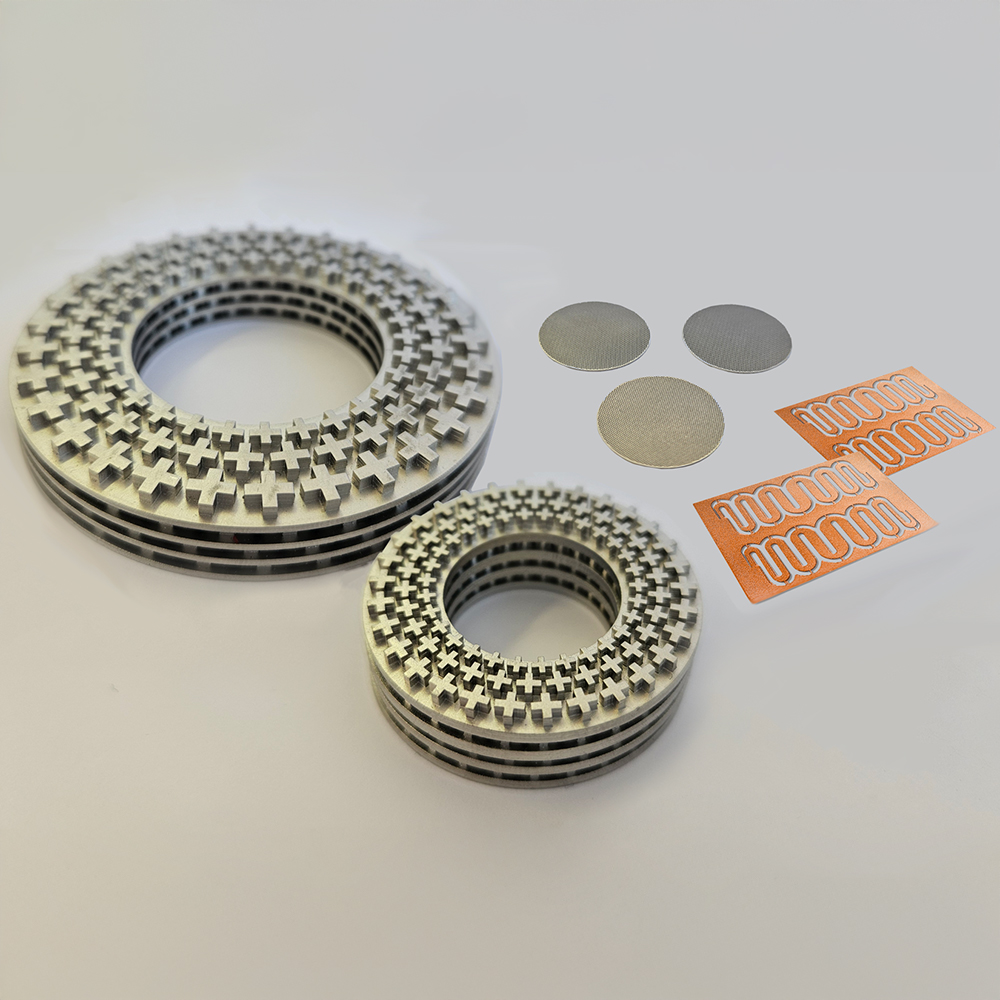

It’s a mutually beneficial relationship. Many (though not all) of the applications we saw at Formnext Asia Shenzhen were first envisioned by Western companies, including aerospace parts, intensive automotive prototyping and tooling, sand molds, directly 3D printed shoes, and toys. Western firms pioneered these products, but Chinese companies are scaling them up to levels their Western counterparts could rarely achieve. At the same time, new applications are emerging in China itself: BLT’s hinges for Oppo and Honor phones, metal shoe molds, and both metal and polymer drone components. Thanks to China’s cost structure for machines and materials, AM of these products has become a truly competitive mass production technology.

Apparently, Chinese companies didn’t get the memo about AM’s inherent limitations — or chose to ignore it. As BLT Shenzhen GM Vincent Yang explained, their approach is to identify constraints and then overcome them. “Working within existing limitations is relatively straightforward,” Yang told VoxelMatters. “But our goal is to break through those limits so the industry can enter a new era. That’s our role: we analyze a market, pinpoint potential applications for 3D printing, and then determine what’s needed to implement additive manufacturing—whether in supply chains, commercial strategies, upfront investment, or final product pricing. With all that in mind, we begin crafting a solution.” For BLT, a company that uniquely integrates hardware, materials, and services, this kind of holistic approach is especially achievable.

What goes around comes around

While China is undoubtedly the fastest-growing AM market today — and likely will remain so in the near future — we must also consider the paradox that Western markets still represent the biggest revenue opportunity. According to VoxelMatters’ latest market report, the global AM market (including hardware, materials, and services) reached $12.2 billion in 2024, representing an 18.7% year-over-year increase. APAC (primarily China) grew 27.3% to $3.7 billion, but EMEA and North America together still accounted for $8.5 billion (70% of the total), despite slower growth rates.

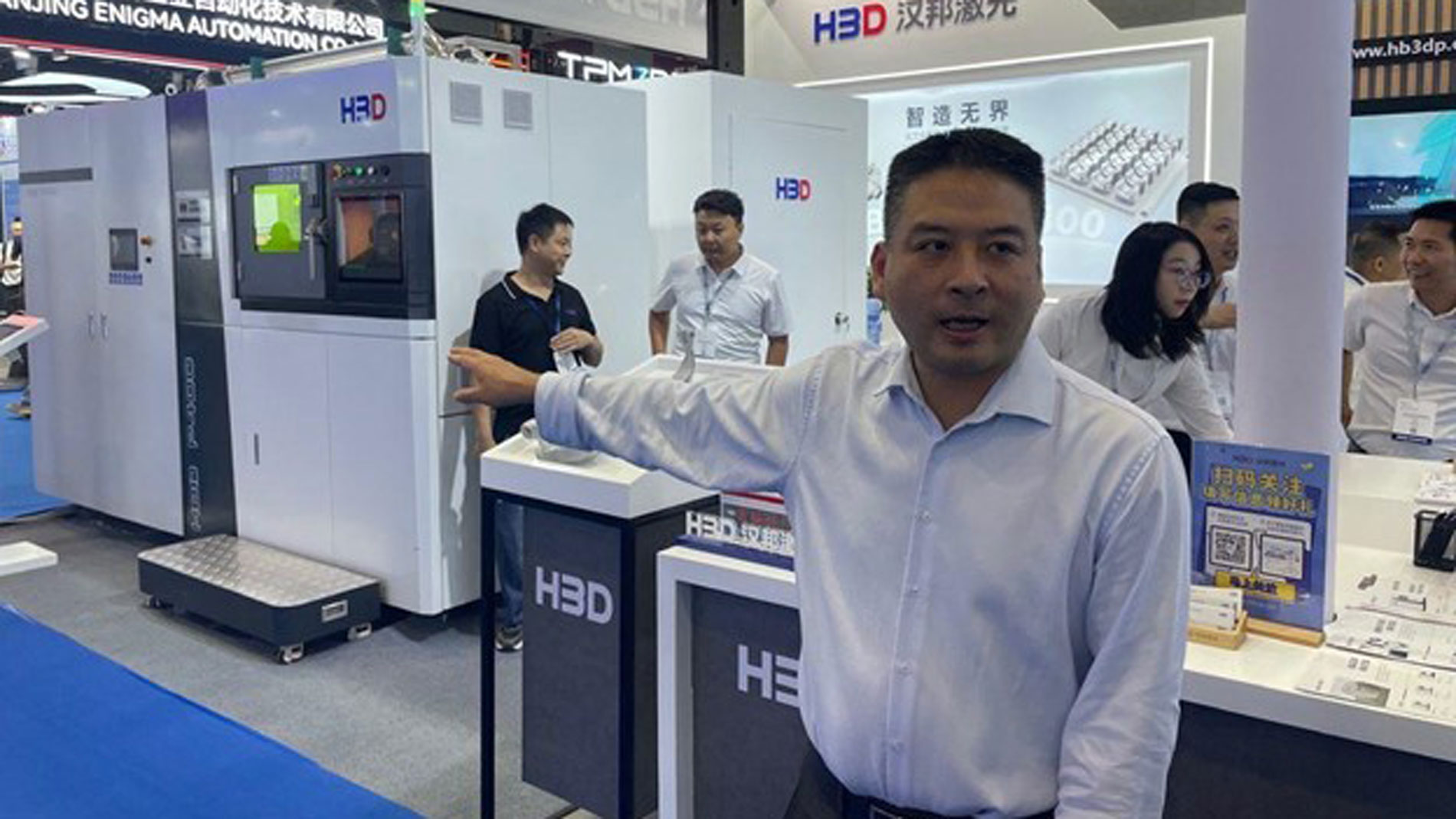

That’s one of the reasons why Chinese companies are increasingly setting their sights on overseas expansion, while also facing fierce domestic competition. In metal LPBF, especially, the local market is getting crowded. Consider Han’s Laser — a company little known for AM — which has now entered the metal AM field with one of the largest booths at the show, right near its massive Shenzhen headquarters (see gallery below). Alongside them, polymer AM companies like UnionTech and Kings 3D are challenging traditional leaders BLT, HBD, and Farsoon. New entrants are emerging in metal AM, using PBF, binder jetting, Laser DED, and WAAM (We’ll be keeping an eye on Enigma). Even HP is joining in — but more on that later.

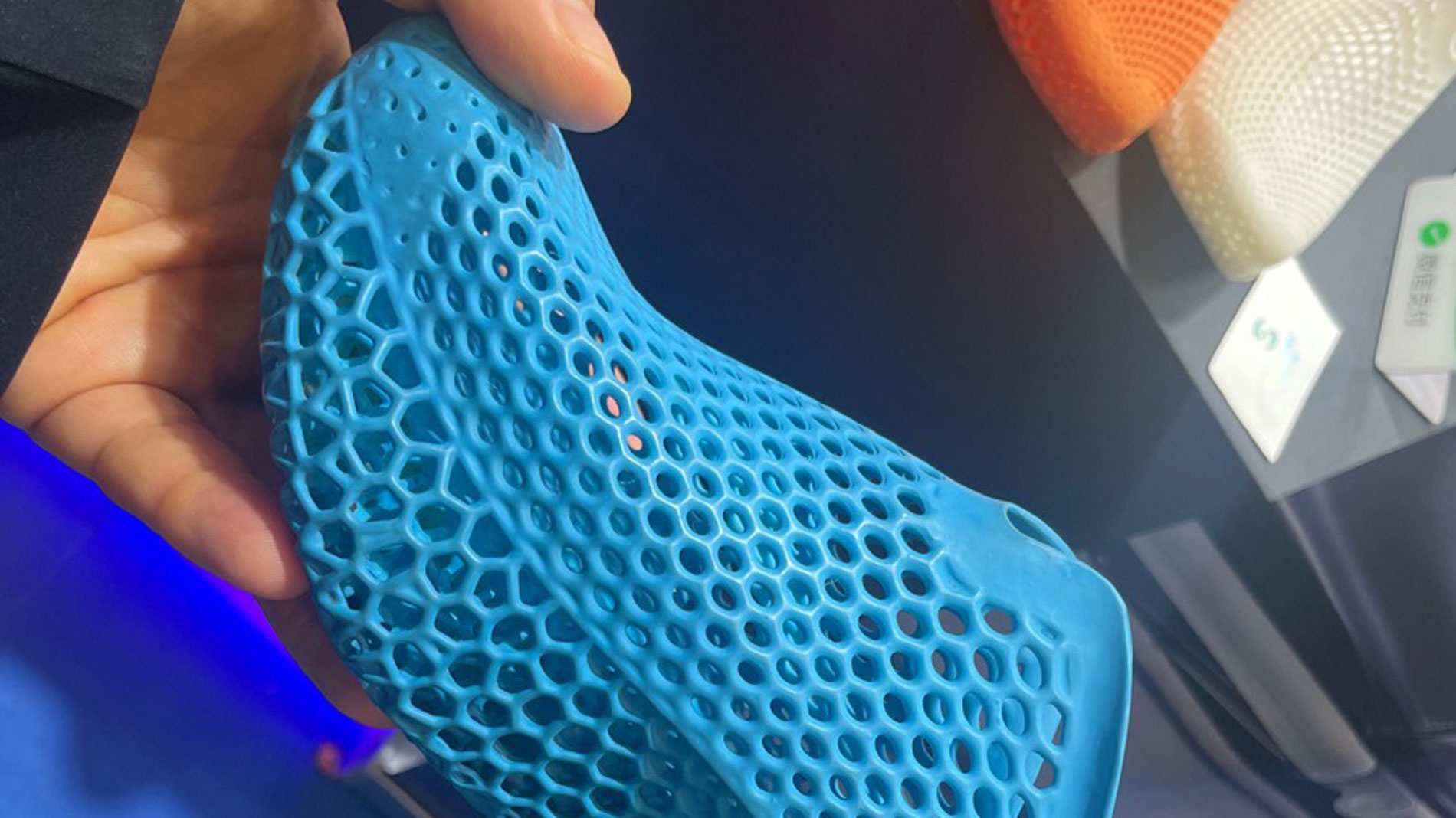

They all see an open field where new winners can emerge. In polymer AM, the market is more consolidated, with leaders like UnionTech, Kings 3D, Farsoon, and TPM3D, plus several rising players. Innovation is thriving, with companies exploring scale in new ways. Mass-produced 3D printed footwear, padding for backpacks, pillows, and even mattresses, as well as enormous 3D printer farms with thousands — even hundreds of thousands — of low-cost FFF machines are reshaping the landscape. German companies like OECHSLER and Zellerfeld pioneered this vision and continue to lead at the high end.

Price will be a defining factor in the next decade of AM — and Chinese companies are aware of this. They understand that they’ll compete on price in Europe and, tariffs permitting, in the US (or by producing locally there). Either way, material and part costs are poised to drop significantly. This price shift may be exactly what Western markets need to rekindle enthusiasm for AM adoption — an enthusiasm that will benefit both sides, provided Western companies continue to innovate. After all, as industry voices have said for years, for AM to scale, hardware, materials, and part costs must come down.

Spotlighting innovation

This price-driven competition will affect only certain products, however. High-end, ultra-performance AM applications will continue to thrive. And it’s not correct to assume that all innovation comes from the West. At Formnext Asia Shenzhen, we saw cutting-edge technologies: Addireen demonstrated one of the most advanced methods for 3D printing copper and other reflective materials (and launched a new 4-laser system); Prismlab showcased ceramic printing at micrometer precision levels we had never seen; and Pollypolymer achieved unprecedented efficiency in TPU lattice printing using DLP. Meanwhile, CNPC Powders introduced new materials like Scalmalloy (as the exclusive reseller for China of APWORKS’ product) and fire-retardant 3D printable magnesium — a breakthrough no one else has yet commercialized.

Another major, and still underappreciated, innovation comes from digitalization platforms and 3D model creation. AI is revolutionizing this area at an unprecedented rate. Scanners from Revopoint and Creality deliver precise capture, but Vast AI’s Tripo 3D online app is a game-changer. In seconds, it generates high-quality 3D printable models from 2D images — in STL and even full-color 3MF — and allows continuous editing.

Vast’s business is split between video game creators and players, as well as 3D printing users. Its API is already integrated into platforms from Bambu Lab, Creality, and Anycubic — and this is just the beginning. As a user of this technology myself (see my 3D model shop on Thangs), I can attest that its future potential for 3D printing applications and adoption is mind-blowing.

So, what does Formnext Asia Shenzhen reveal about the state of the Chinese AM industry? Let’s take a closer look.

Polymer, metal and ceramic insights from Formnext Asia Shenzhen

First, Shenzhen itself. The fair’s venue was spectacular — vast, modern, and impressive, like everything in this region (especially the airport). Traffic was challenging, but Didi (China’s Uber equivalent) made getting around affordable and even pleasant. Roughly 75–85% of cars are electric — identifiable by green license plates, while combustion vehicles carry blue ones. Interestingly, most blue plates were on Western-made cars. Chinese EVs seem poised to disrupt the world just as forcefully as Chinese 3D printers. The Greater Bay Area is vast, and although distances are considerable, the atmosphere everywhere feels vibrant and optimistic. Visitors must adapt to Chinese apps like WeChat and Alipay and likely use a translator app — but it’s a valuable learning experience.

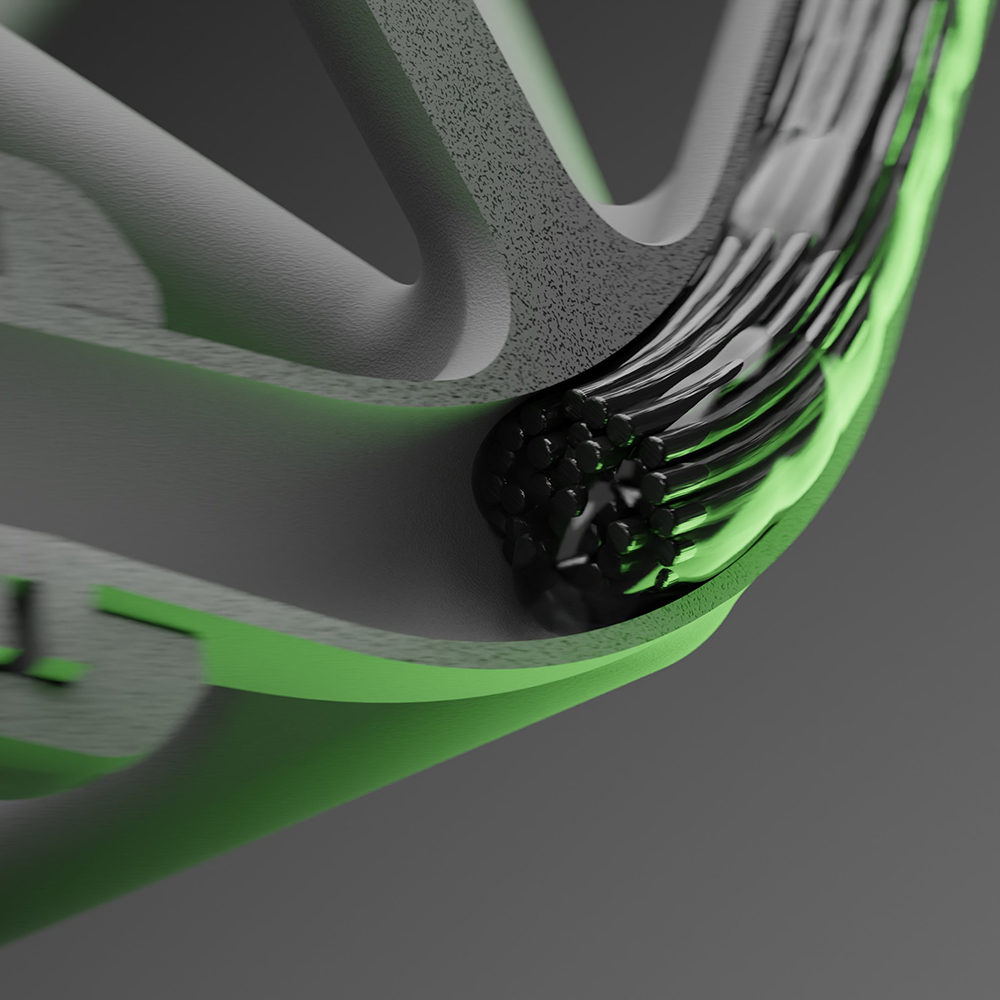

The show itself filled one of the 18 huge halls of the Shenzhen International Fair. That’s about a third the size of Frankfurt’s Formnext — comparable to the German show’s early days. Most booths were well-curated, neat, and full of working machines (including some that printed with sugar!). Traditional leaders, such as BLT, Kings 3D, HBD, UnionTech, and Farsoon, showcased both metal and polymer capabilities. However, the spotlight this year was clearly on footwear — from metal molds to directly 3D printed shoes. Shoe displays were everywhere, and many attendees were wearing them.

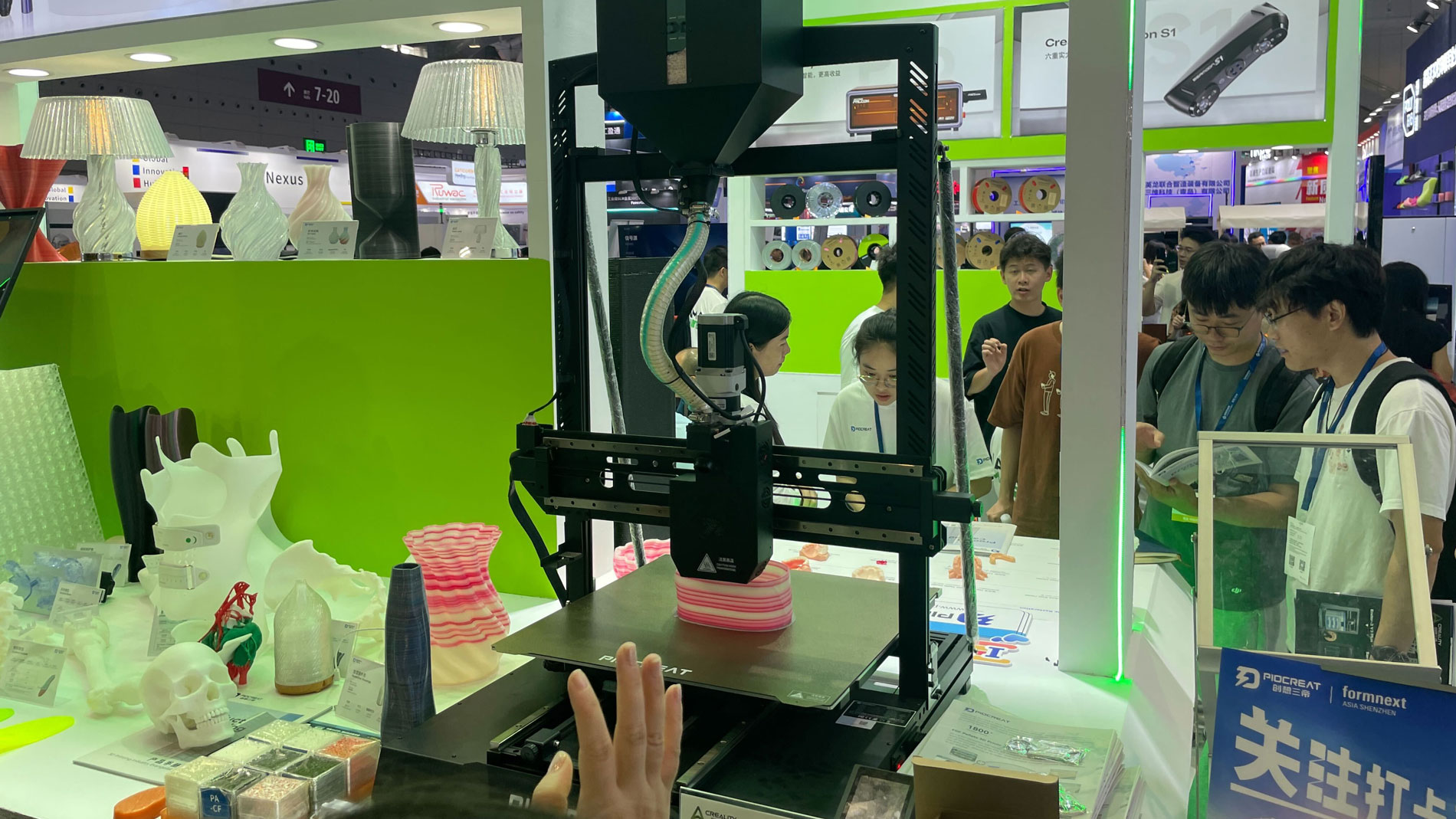

The 3D printer farm section was equally impressive: tons of 3D printed, and very nicely packaged, with Creality leading the way, supported by filament manufacturers like eSun, Kexcelled and SUNLU, as well as local innovators like Infinitri 3D.

In polymer AM, TPM3D stood out as a rapidly rising player, sharply focused on SLS and its many applications. (Yes, they also printed their own version of the Wilson basketball. While not NBA-grade like the Wilson-EOS collaboration, it bounced well — and with economies of scale, its production cost could be well under 1000 RMB, about $100 USD.) Kings 3D and UnionTech remain locked in competition for SLA dominance while also offering multiple other technologies.

Shenzhen-based Bambu Lab, notably absent from the show, left Creality as the undisputed leader in desktop 3D printing, with Elegoo trailing far behind (judging by booth size). Creality showcased advances across material extrusion, from full-color desktop printing to massive 3D printer farm setups, even including a benchtop pellet printer from its Piocreat division. Elegoo, meanwhile, focused heavily on resin machines that deliver impressive quality at very low cost. Among materials suppliers, eSun and newcomer Kexcelled emerged as leaders in filaments and resins. Ecocity Biomaterials also made waves, positioning itself as a direct competitor to NatureWorks’ INGEO in China’s PLA market, with an annual output of 60,000 metric tons (set to reach 150,000), about 20% of which is dedicated to 3D printing filaments — a staggering volume.

In the metal industry, the key players remain BLT, HBD, and Farsoon, with UnionTech and Kings 3D as notable challengers. Farsoon and BLT, both publicly listed companies, each generate about half the revenue of giants like Stratasys, 3D Systems, and EOS — although their market caps are significantly larger. (Notably, Stratasys and 3D Systems are only marginally involved in metal AM, while BLT focuses exclusively on metal.) HBD’s revenue is less transparent, but Overseas VP and European MD Rodgers Ma stated that they have sold 1,000 metal printers, approximately 25% of which have been sold overseas. A major game-changer here is powder availability, with CNPC Powders emerging as a leader in China and aggressively expanding abroad. The company already has a storage facility and offices in Germany, with further expansion planned. Management made clear their intent to compete not only on price but also on breadth of materials and significant atomization capacity.

Hua Zhao, Head of Greater China Market, Personalization & 3D Printing at HP, explained that the company is aggressively targeting China, for MJF and., perhaps even more so, for Metal Jet technology adoption.

And then there’s HP — firmly planting its flag in China. At the show, we spoke with Hua Zhao, Head of Greater China Market, Personalization & 3D Printing at HP, who emphasized China’s role as a key growth market, particularly for its metal binder jetting technology. HP remains confident, citing its unmatched expertise in jetting technologies as a competitive edge in both binder jet and MJF.

Ceramics is another vibrant segment reflected at Formnext Asia Shenzhen. Chinese companies are active across the spectrum, from technical ceramics to sand. Firms like 10Dim and Prismlab are advancing technologies that range from ultra-large to micro-scale ceramic stereolithography, and they’re preparing to showcase at Europe’s CeramTec in Munich next year. CH Leading is advancing large-format sand binder jetting, whereas companies like Foshan CeraPI remain focused on the domestic market, addressing growing local demand.

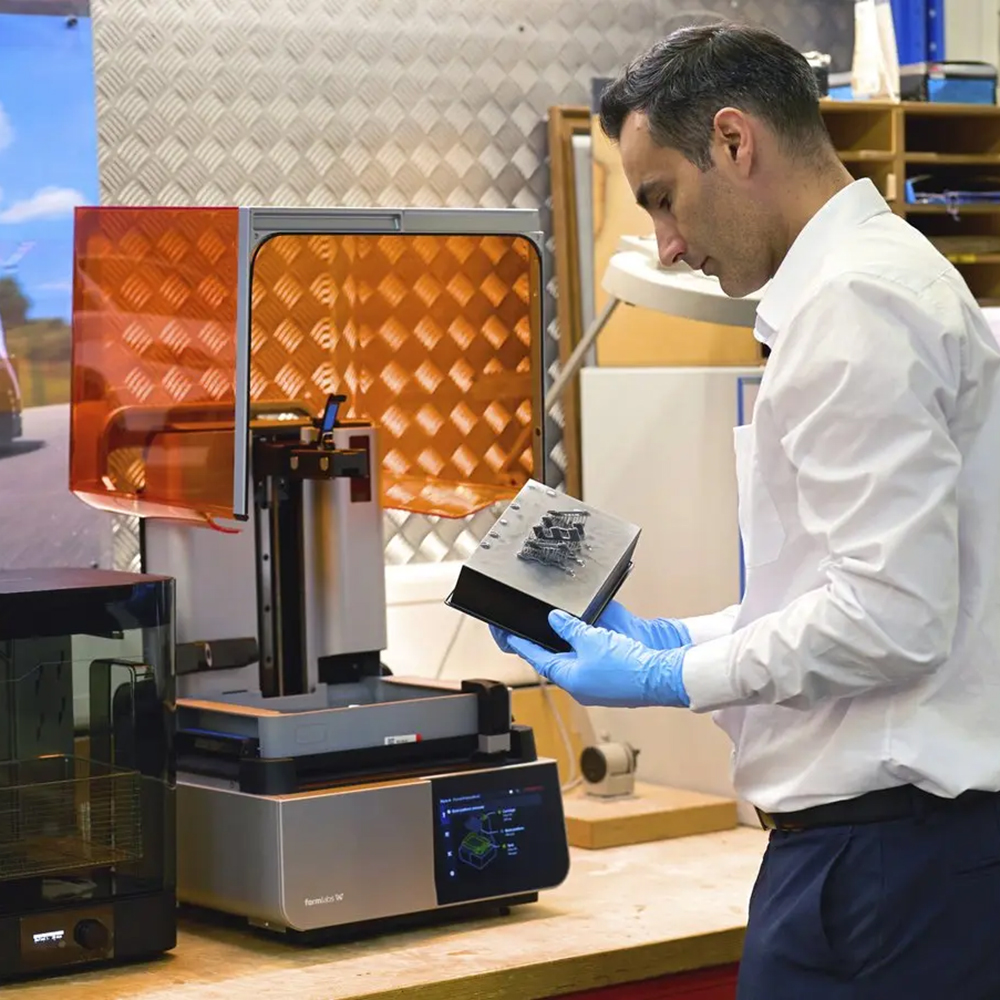

Mentioned here are just some of the key companies we had the chance to connect with, but the show floor had lots more to offer. From EASYMFG’s (and others) metal binder jetting to affordable benchtop SLS systems (by the way, Formlabs just opened a new office in Shenzhen), to innovative material extrusion and stereolithography products, the stage is set for an even bigger show next year.

Until then (or until Formnext Frankfurt), we leave you with some more photos of interesting things seen on the show floor:

Further Information

Link to the original article, published on 29 August 2025: https://www.voxelmatters.com/formnext-asia-shenzhen-sets-the-stage-for-the-next-decade-of-global-am-growth/