Text: Thomas Masuch

Reading time: 6 minutes

Takeaway 1: Cautious optimism that the period of disillusionment is over

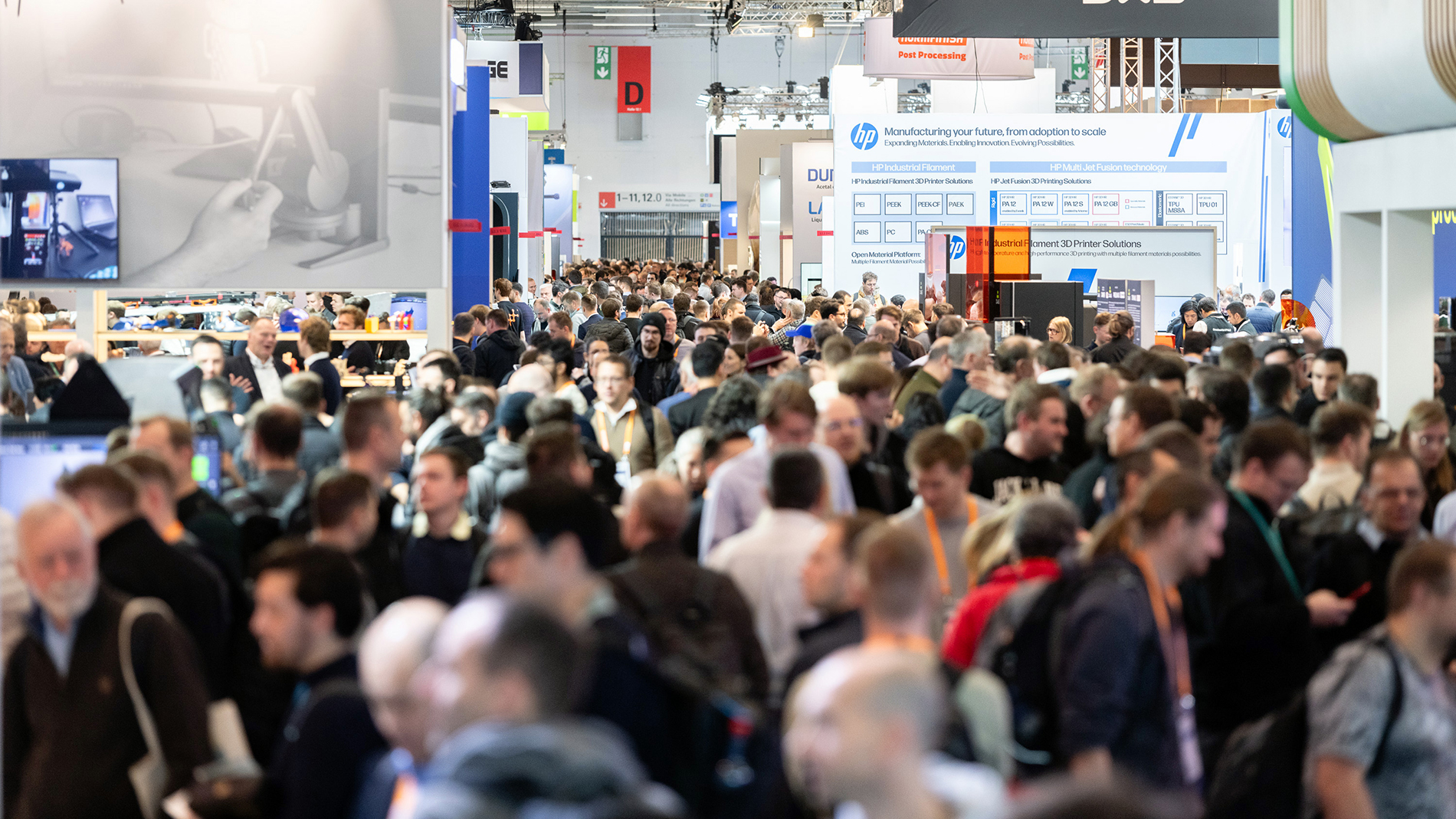

Not so long ago, some AM companies promised that the technology would revolutionize manufacturing and in the future, printing would replace milling or injection molding. This mobilized millions (or even billions) of US dollars from investors, but in most cases, it was not sustainable in the long term. The brief hype that arose during the pandemic was followed by disillusionment and the (somewhat anxious) question: Which companies were already stable enough not only to live off their cash flow, but to continue to invest and grow? And so the omens for this year’s anniversary Formnext were not all that ideal: The industry was undergoing consolidation, major players were withdrawing, and analysts were reporting growth almost exclusively in Asia. But then came 18 November, and just two hours after the trade fair opened, the aisles were full. In the end, Formnext reported a record attendance of 38,282 specialists and executives (47% of them from outside of Germany), which is all the more remarkable considering that the number of exhibitors was slightly lower than last year. “We are already experiencing a huge rush of visitors in the morning and spending the day in intensive and productive discussions,” said Stefan Krzykowski, area sales manager for southern Austria/Switzerland at MHG Strahlanlagen GmbH. Kai Witter, chief customer officer at Dyemansion, summed it up succinctly: “It's not just well attended – it's really packed!”

Takeaway 2: New phase in the maturation process – a new era for AM?

The enormous progress the industry has made was also evident in the way business and discussions are now conducted at Formnext. Instead of thrilling potential and questions about what might be possible with AM, the focus is now on concrete cost planning. And perhaps this marks the beginning of a new era for the additive world, one that can at least partially deliver on promises made in the past. “The maturation process, which has been accelerated by consolidation, is stabilizing the industry and opening up new opportunities,” explains Kai Witter. "We can sense this in our discussions with AM users, such as when they ask about concrete business cases where they know that AM is the right technology. The focus is increasingly on concrete costs – especially total cost of ownership, including infrastructure.”

Andreas Langfeld, president of EMEA and APAC at Stratasys, also reported on the changing market at Formnext. "We’re in a phase of disillusionment. The market is maturing, and customers are coming to us with specific application examples. As a supplier, you have to think in terms of processes, from CAD to design to planning the entire workflow. In the end, it's the cost per component that counts, and that's the deciding factor. Meanwhile, interest from manufacturing companies is growing. Two factors are crucial here: cost and process reliability."

Takeaway 3: Consolidation not necessarily a negative development

Directly related to this “disillusionment” or rather “new phase in the maturation process” is the consolidation that the market has experienced this year, which was also evident at Formnext. Formerly important players have withdrawn from the AM world either completely or gradually (BASF and Arburg, among others), while the likes of Trumpf and Sodick/Prima Additive have outsourced their AM divisions and given them new brand names. Atlix and Altform presented themselves for the first time at Formnext 2025. Matthias Himmelbach, CEO of Atlix, saw Trumpf's new independence as an additional opportunity while emphasizing that Trumpf's AM division had also concentrated most of its AM activities in northern Italy, at Atlix's current headquarters. There were also smiles all round at Dyemansion’s takeover of ASM (which was announced shortly before Formnext) and the Sintokogio Group’s purchase of Bosch Advanced Ceramics (also announced and celebrated at Formnext). The Japanese group, which already owns 3DCeram Sinto, is thus gradually expanding its portfolio of AM companies, especially in the ceramics sector.

Takeaway 4: Industrial applications becoming the benchmark

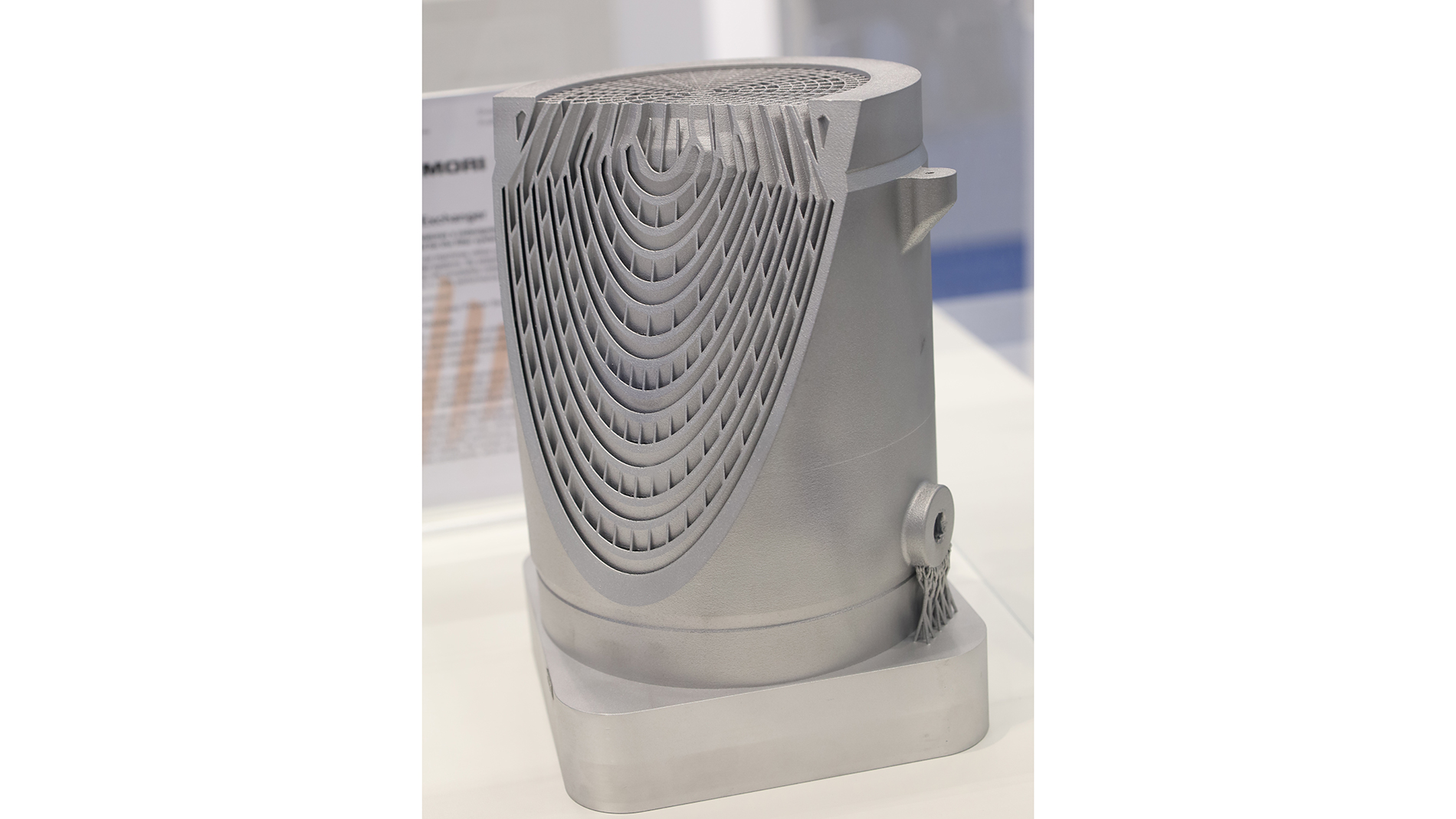

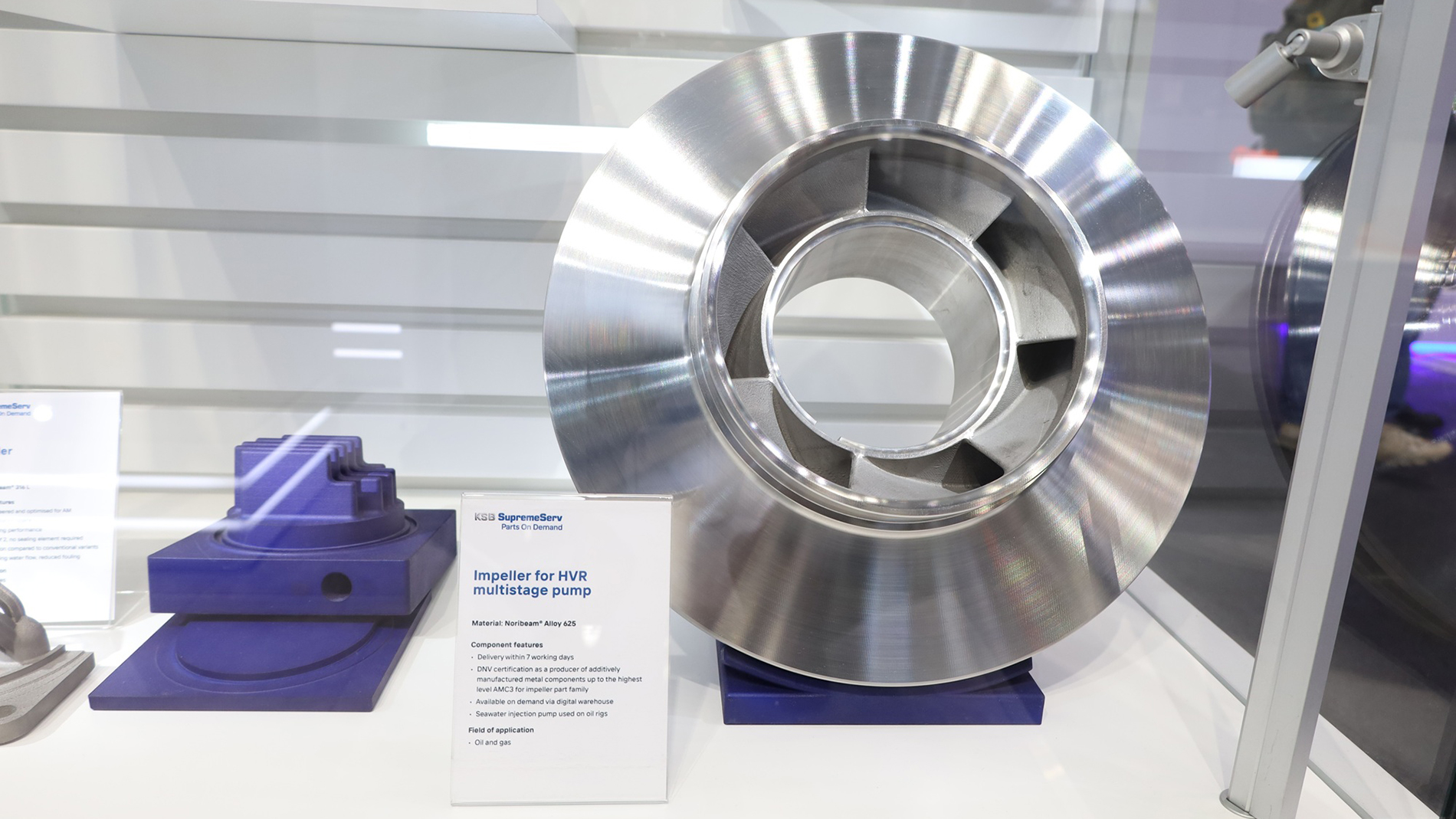

In addition to the numerous developments in the business sector, there were many changes on the construction side, with exhibitors showing off many more concrete applications. Whereas in previous years, pilot projects or demonstrators were often exhibited alongside AM systems (especially in the metal sector), this year's displays increasingly featured heat exchangers, engines, manifolds, or components from compressors, power plants, or pumps – often from specific applications. Instead of showing what is possible as in the past, the focus was on demonstrating how things work.

Takeaway 5: Affordable FDM desktop printers – moving into (semi)professional use

What started as consumer-grade desktop printers is now becoming a serious contender in entry-level industrial applications. A clear sign of this shift was the massive buzz around the launch of the Bambu Lab H2C. Leading players in the FDM desktop segment—such as Bambu Lab, Prusa, and Creality—are improving their technology and thus expanding the range of industrial applications – including through multi-material processing or the printing of special filaments (such as silicone)

The potential of these companies and desktop technology in general is evident in the sales figures alone, with Bambu Lab selling more than one million 3D printers on its own in 2024. The possible applications are also wide-ranging in the industrial sector, and desktop printers make it possible to utilize AM very well at scale (for more, see our technology report ). Recently, even material manufacturers have been equipping their customers with Bambu Lab printers for material qualification purposes. Another ripple effect? Lower entry costs are broadening the user base—schools, universities, and young talents are embracing the technology. Many of these future professionals will eventually bring their experience into the industry, fueling the next wave of innovation.

More information:

Part two including the following trends: