Text: Thomas Masuch

In the automotive industry, there are probably few AM service providers with as much experience as Cirp (based near Stuttgart, Germany). “At Cirp, we have grown and matured with this industry for 31 years. Today, we sense a great deal of uncertainty in it,” explains Thomas Lück, head of sales and innovation at the company. Nevertheless, Lück continues to see potential, particularly in Additive Manufacturing: “AM and rapid tooling remain in demand. This applies to all stages of the supply chain and to the various drive concepts.”

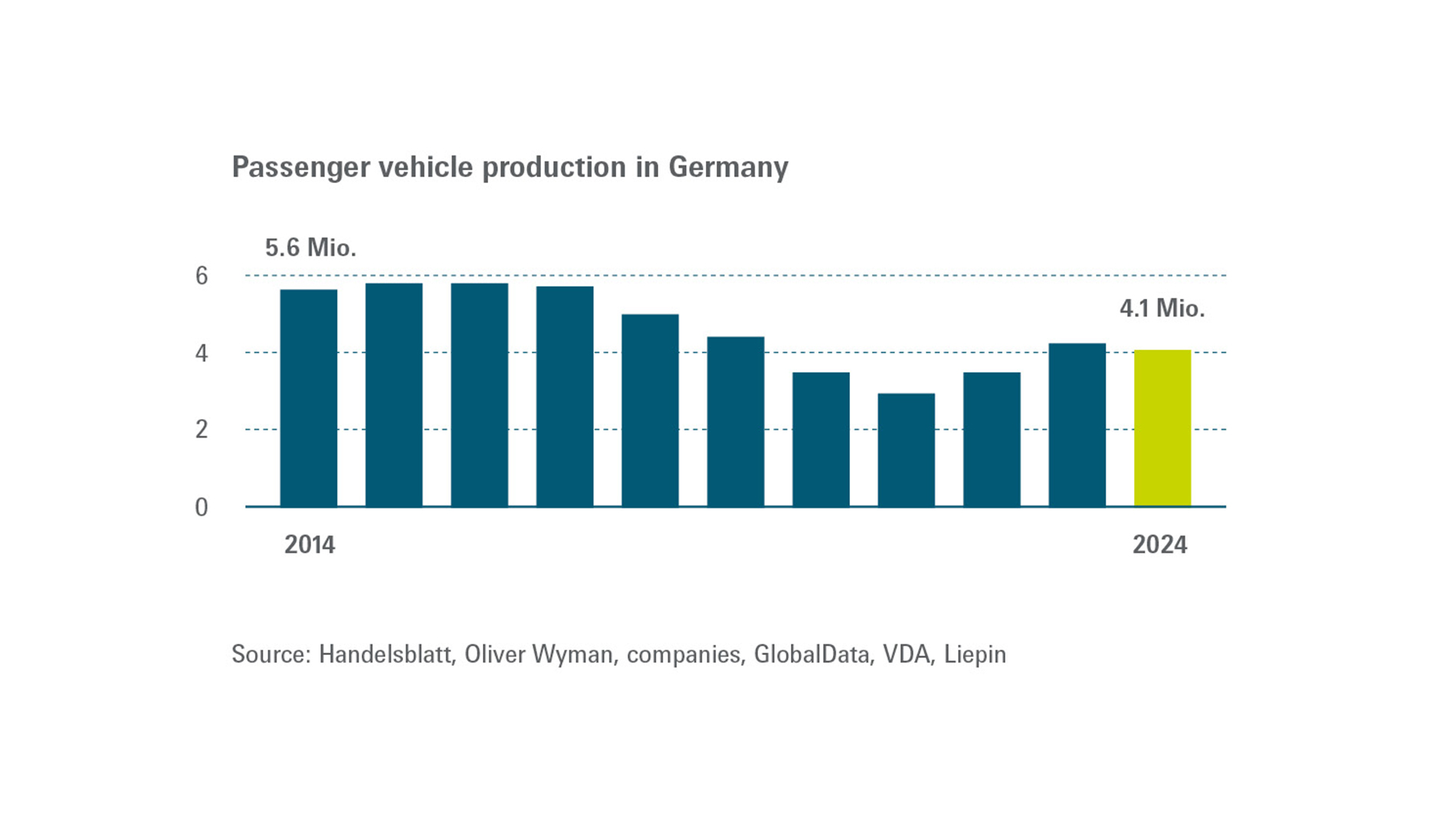

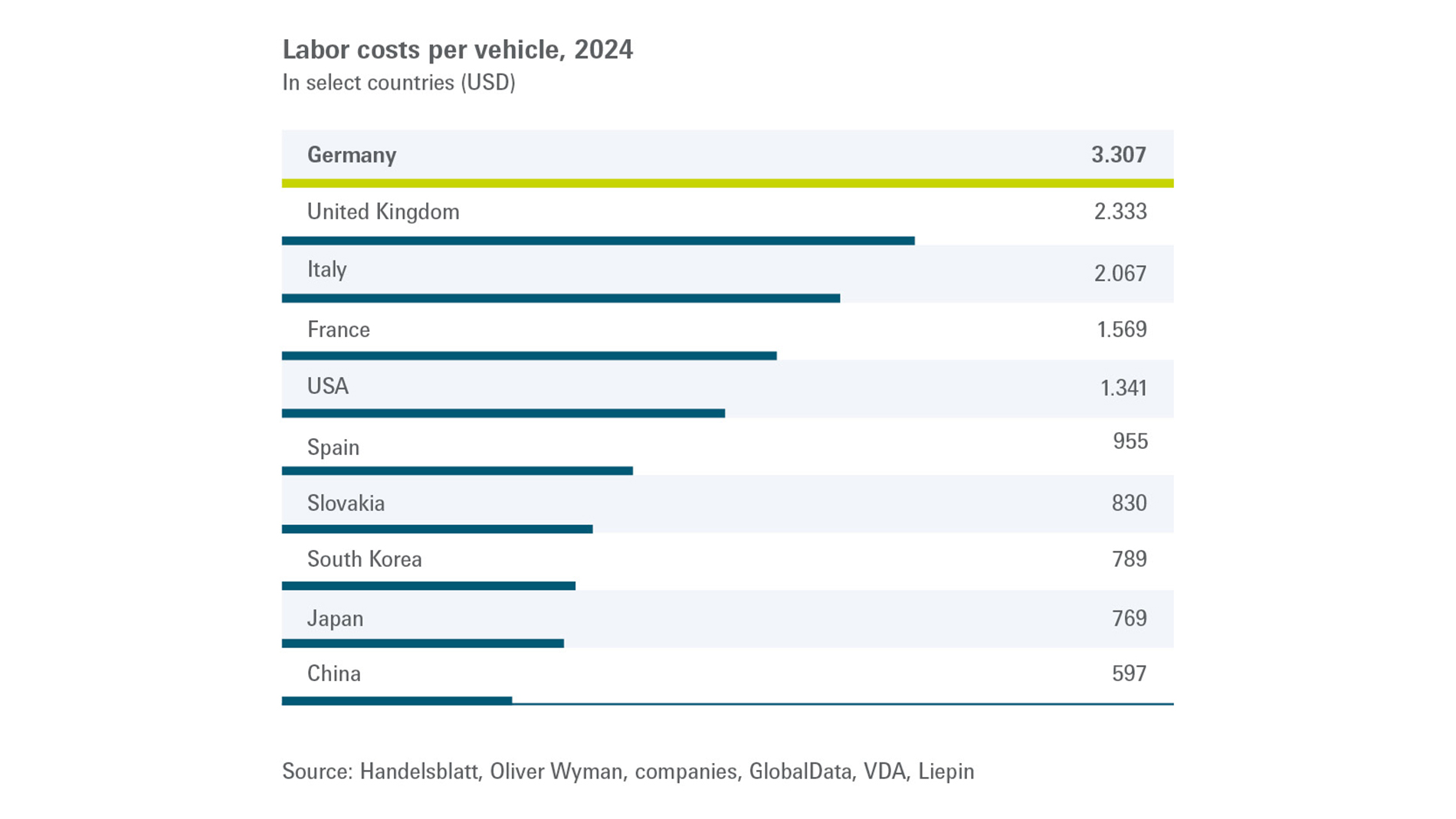

According to the Wohlers Report 2025, the automotive sector is one of the most important user industries: Last year, the global AM industry generated 10.3 percent of its revenue here. This puts the automotive industry close behind medical (11.1%) and aerospace (10.6%). However, the automotive industry, which in this article also includes motorsports, trucks, and buses, is currently going through challenging times. While sales figures are stagnating, production costs remain high – especially in Germany, where building a car costs around 5.5 times as much as in China (see chart). It is therefore not surprising that VW, for example, has opted for an extensive cost-cutting program: Among other things, a quarter of the 130,000 jobs in Germany are to be cut by 2030.

Cost-cutting programs noticeable

The AM industry has also been affected by cost-cutting programs like these in recent years. According to the Ampower Report 2025, sales of AM equipment in the automotive sector declined significantly between 2022 and 2024 – from €260 million to €190 million, a drop of around 27 percent. These figures are also consistent with Thomas Lück's experience: “Demand and predictability have suffered. The uncertainty is also affecting small projects, and decisions are being postponed unexpectedly.” According to Lück, this means that “flexibility and capacity planning are now more challenging at Cirp,” although the company is “able to respond with a healthy structure and equipment.”

Ampower's experts, however, are predicting a significant trend reversal in the coming years. By 2029, AM sales in the automotive sector are expected to grow significantly again, by 13 percent annually to €360 million in 2029.

Trend reversal in AM applications

The reasons for this positive turnaround vary depending on which automotive sub-sector you consider. In the area of passenger car series production, “much potential remains untapped,” explains Mathias Schmidt-Lehr, founder and CEO of Ampower. Thomas Lück has also noticed that “many customers are now recognizing the advantages of AM and rapid tooling in particular in implementing short-term decisions quickly and with little investment while accelerating development and gaining the ability to deliver on short notice.” The AM experts at Wohlers Associates are also seeing a rising number of applications in the automotive sector. “Binder jetting remains a very good technology and, in the right hands, can deliver significant added value. Unfortunately, in recent years, exaggerated marketing promises have created unrealistic expectations that have not been fulfilled as quickly as hoped,” explains Mahdi Jamshid, director of market intelligence.

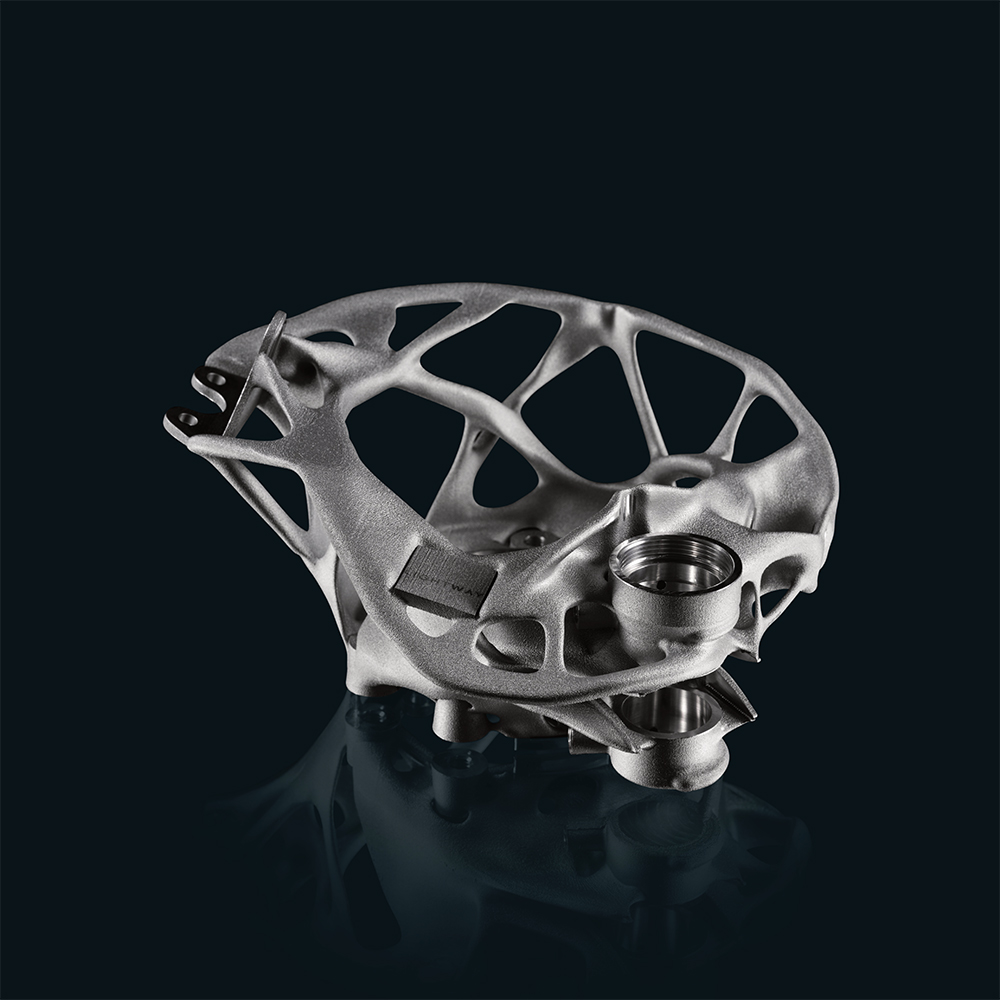

In addition, the motorsport sector is proving to be a stable growth market for AM. Here, more and more 3D-printed components are finding their way into Formula 1 cars and super sports cars. The trucks and buses segment also offers great potential for Additive Manufacturing, especially in the area of spare parts. One example of this is the development of the AM division at Daimler Buses.

Potential in production tools

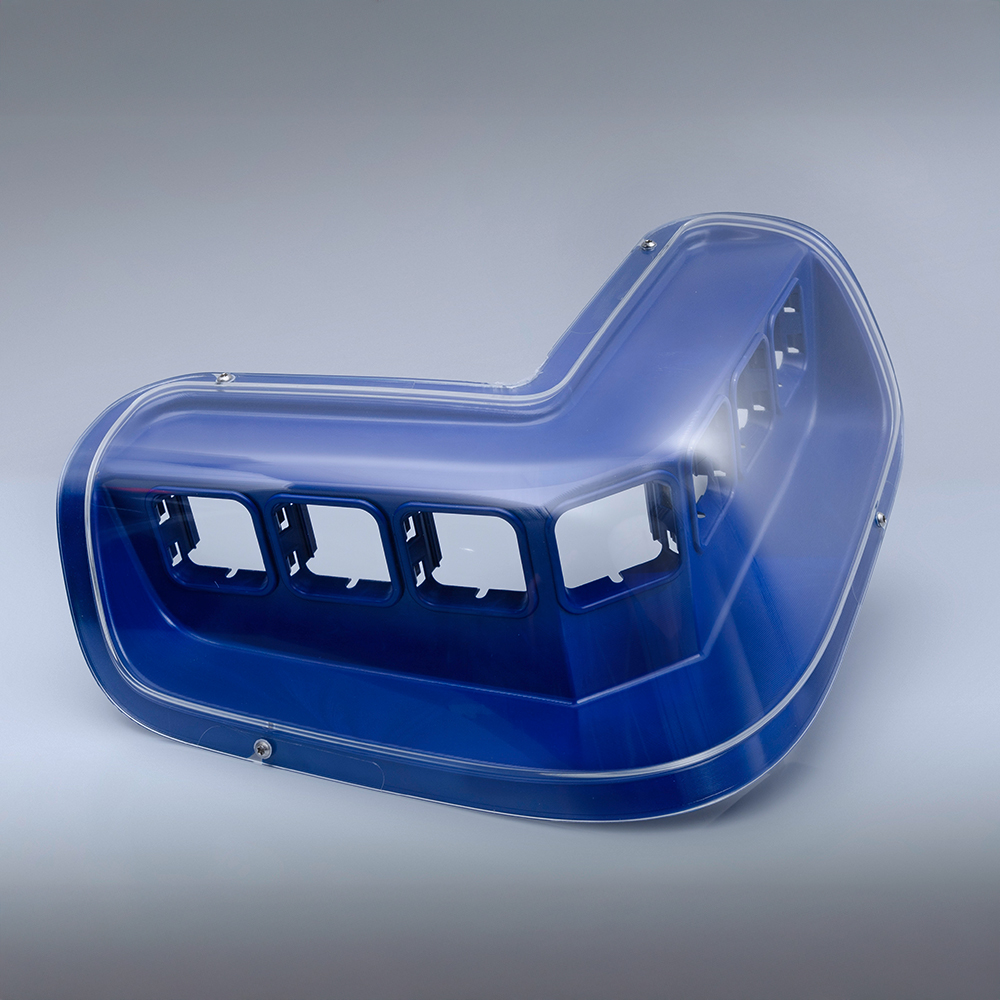

In addition to prototypes , Additive Manufacturing plays an important role in car series production, especially in production tools. In a recent study, however, experts at Ampower have found that there is still a lot of potential for more use of AM in this area: While AM is already used very efficiently in the early design phase, only a small portion of its potential is being exploited in areas such as robot grippers or injection molding tools. “Around 80 percent of the market for production tools in the automotive industry is still untapped,” explains Matthias Schmidt-Lehr. “This offers OEMs an enormous opportunity to increase their productivity and uptime while reducing the cost of production equipment. This is facilitated by the increasing availability of inexpensive, user-friendly printers.”