6 March 2023, by Thomas Masuch

The market for additive metal powders is experiencing a real boom phase: Demand is increasing rapidly, users have an even greater choice of suppliers, and the range of powders is also growing. For established manufacturers, this is both an opportunity and a challenge; young companies, on the other hand, want to establish themselves with new offerings. These developments are likely to give an additional boost to the entire AM market.

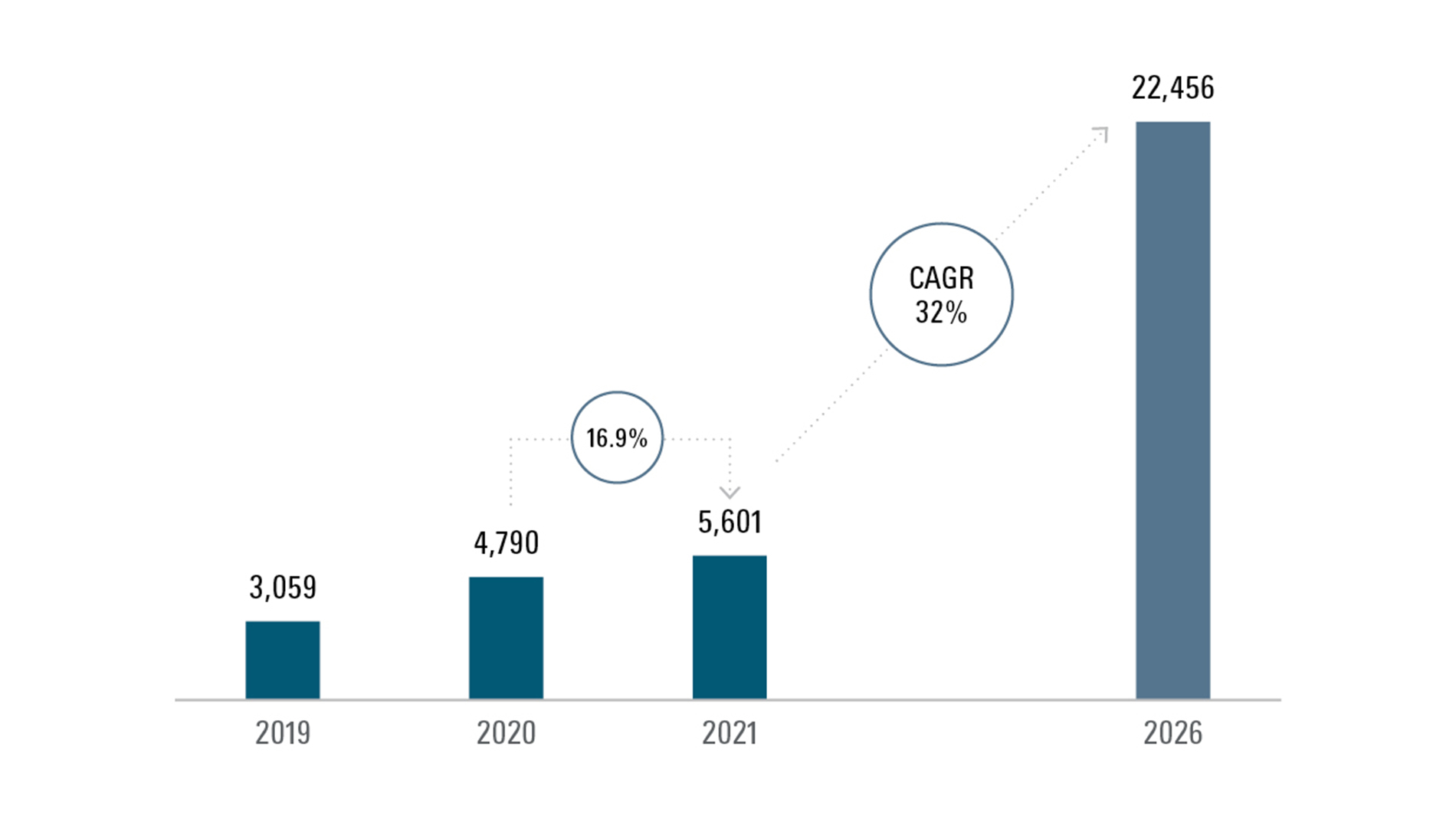

Metal powders may not be particularly spectacular visually, but they are the basis for numerous developments and innovations in additive manufacturing. In this regard, the powder sector has picked up an enormous pace of late. The Hamburg-based additive manufacturing consultancy Ampower expects annual sales to increase by more than 30 percent over the next four years, with the annual demand for metal 3D-printing powder rising from 5,601 tons in 2021 to 22,456 tons in 2026.

This development shows that the number of applications is also continuing to rise, and that additive manufacturing is making significant progress on its way to industrialization. At the same time, the expanding powder market offers promising business opportunities for more and more suppliers both new and more established. "The number of powder manufacturers is steadily increasing, leading to higher competition," explains Maximilian Munsch, co-founder and CEO of Ampower. "In all groups of metal materials, such as steels or nickel-based alloys, there are more than three or four dozen internationally competing manufacturing companies for a product that often allows for few unique selling points."

"Very good quality from many manufacturers"

For powder expert Yannik Wilkens, standard powders "have developed into a commodity product that can be obtained from many manufacturers in a very good quality. It is becoming rarer and rarer for customers to buy from a powder supplier or from the manufacturer of their machine solely for reasons of trust." Wilkens, co-founder of the Qualloy materials platform, thus concludes that price is playing an increasingly important role in purchasing. "The reason for this is certainly also that AM machines are becoming more and more efficient, which is bringing down the cost of a machine hour, while the proportion of powder costs in the end product is rising. Lack of transparency and extensive requirements for metal powders used in additive manufacturing also make comparing powders on the market an arduous task."

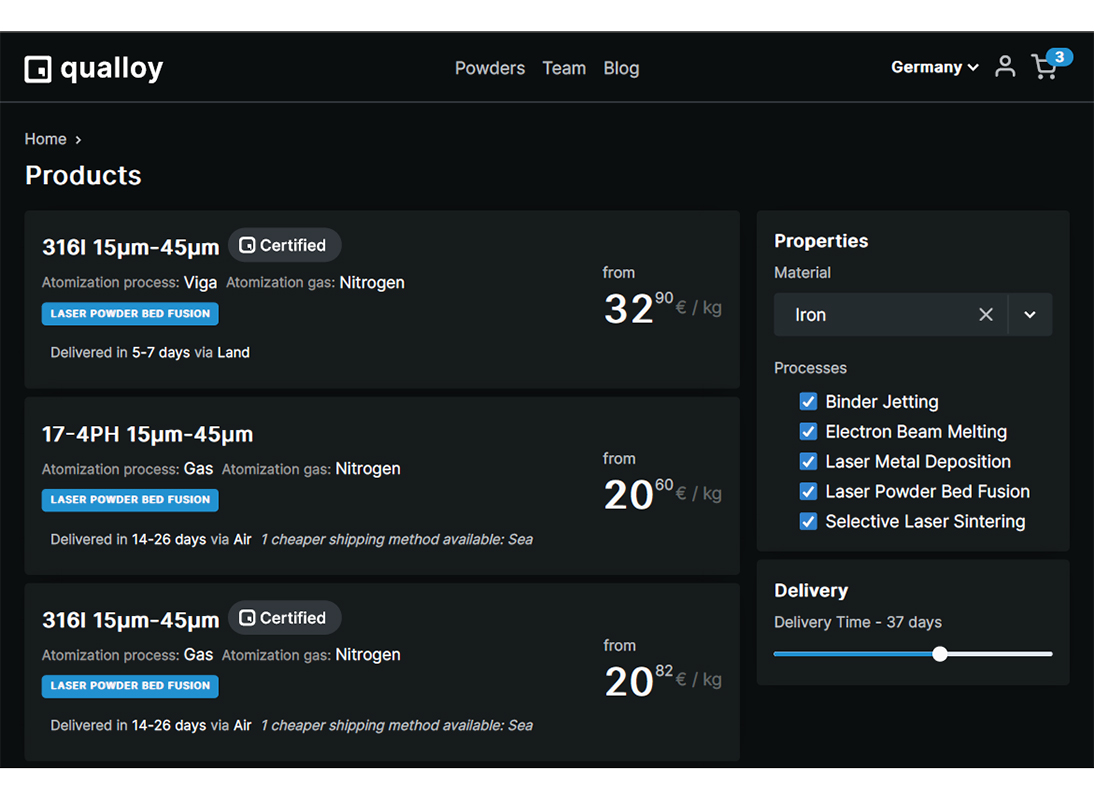

Wohlers Report 2022 also notes that in the metal powder industry, sales prices are generally not published and "remain confidential between manufacturers, distributors, and customers." For Yannik Wilkens, it was then obvious that the AM market needed a way to easily compare prices and different specifications from audited powder manufacturers. Together with Tobias Brune and Daniel Hariri, he founded Qualloy, which launched a digital marketplace for metal powders under the same name in late 2022. "We want to make purchasing metal powders cheaper and more transparent," Wilkens explains. In addition to potentially lower prices, he wants to achieve a streamlined procurement process: "Until now, it wasn't that easy to compare quality and prices on the powder market." Many inquiries would cause a lot of effort for buyers and sellers. In addition, the process would often be complicated by different quality specifications due to other measurement methods or parameters. "The sales effort required to get into business is currently quite high for both buyers and sellers, which is especially annoying for smaller order quantities,” Wilkens adds.

Yannik Wilkens, co-founder of the Qualloy materials platform. Image: Qualloy

On the platform Qualloy, two manufacturers are offering various metal powders, and others are currently undergoing certification. Image: Qualloy

Powder price partially declining

According to Maximilian Munsch from Ampower, the fact that the number of suppliers of metal powders continues to rise has already led to a situation where "in some areas, the powder price has fallen sharply in recent years, such as in titanium materials for PBF processes. Here, powder prices have declined by nearly half. For other materials – stainless steels, for example – prices have remained at a relatively constant level."

Established powder supplier Fehrmann Materials has also recognized the trend in customers reacting much more sensitively to price than before. "Price sensitivity is so high that even sums of less than one euro per kilo can lead to serious discussions with partners," says sales VP Jan-Peter Derrer.

Derrer, who has worked in the AM industry for almost 20 years, is also convinced that an expansion of industrial 3D printing will require a significant reduction in price. The scope for this is certainly there, he says, because the "volumes of powder produced worldwide are now so large that suppliers can pass on economies of scale".

Pricing campaign for standard materials

In response, Fehrmann has modified its pricing strategy for standard materials. "We went on the offensive at Formnext 2022 and offered our powders at extremely attractive prices," says Derrer. "This resulted in us selling almost all of our inventory during the event. It also showed us how sensitive this area is and how grateful people are when things go in the right direction."

Fehrmann's goal here is to bundle customers' powder needs in order to purchase large quantities at more favorable prices, which can then be passed on. The company hopes that increasing both its sales volume and customer numbers will ultimately pay off in sales of its own special alloy, AlMgty. "New ideas are often born in personal dialog and then give rise to new projects," Derrer explains, and immediately provides an example: "One of our customers wanted to anodize 3D-printed aluminum parts in deep black, but this does not work well with conventional AlSi10Mg. AlMgty is much better suited for it."

Consistent quality as a purchasing criterion

On the other hand, Andreas Pelz – founder and managing director of m4p, a firm based in Magdeburg, Germany – is somewhat more conservative in his assessment of the importance of powder price. "Our customers' buying criterion is essentially that we have been supplying consistent quality for years and have had no complaints – especially due to our extensive quality assurance measures. Price also plays a role, of course, but it’s not the number-one issue." As an example, he cites how the market has also been dominated by the issue of supply security in the recent past, "where we were under constant pressure to be able to keep our delivery promises."

m4p makes a large part of its sales with standard materials such as AlSi10Mg, copper or nickel alloys, titanium, and various steels. In total, the company has 54 standard materials like these in its portfolio. “These are available from stock, and we have standard parameters and a defined process chain for them,” says Pelz. In addition, m4p offers customized powder materials, which has grown the company’s total product portfolio to 188 items. For Pelz, this also reveals the diversity of material and process variants in additive manufacturing, which range from LPbF and E-PbF to DED and binder jetting.

Special materials to have more weight in the future

Special materials are the topic that Pelz's R&D team is passionate about. “Here, we are working on completely new types of materials that can also only be processed using additive technology,” he says, adding that he expects further leaps in innovation from new types of metal matrix composites (MMCs) and in the area of metal powder processing.

The development of further special alloys also plays an important role at Fehrmann, even though standard materials still account for the vast majority its sales, as well. "In the future, we expect a significant increase here," says Derrer.

When developing alloys, Fehrmann Materials not only has the additive process in mind, but all manufacturing processes used over the life cycle of a component. "This ranges from 3D printing in prototyping to small and large series production – for example, in die casting, sand casting, extrusion, or spare parts, also in 3D printing,” says Derrer. In material development, Fehrmann is increasingly relying on artificial intelligence to develop new materials faster and more cost-effectively. zu entwickeln.

Qualloy

According to co-founder Yannik Wilkens, this digital platform, which brings together manufacturers, buyers, and users of metal powders, is intended to ensure greater transparency and thus also reduce the overall price level. "Via Qualloy, users can find the right powder for their machines and specifications in the shortest possible time and choose between different tested manufacturers in terms of quality, price, and delivery time." Currently, two powder manufacturers offer different metal powders on the platform, and others are in the certification process.

m4p material solutions

This company was founded in 2015 by Andreas Pelz, who comes from a metallurgical background. "At that time, there were few materials for 3D printing, so I saw opportunities in this niche,” he explains. m4p now has four locations around the world and plans to expand further.

Fehrmann Materials

Fehrmann Materials is a subsidiary of the Fehrmann Tech Group, a traditional company based in Hamburg, Germany. A few years ago, the company decided to make some of its high-performance aluminum alloys available for additive manufacturing, as well. Of the 50 employees at Fehrmann Materials, around 20 are now involved in additive manufacturing. Then, in 2018, Fehrmann Materials launched "AlMgty": an aluminum alloy with magnesium content that the company offers in different variants. According to Jan-Peter Derrer, VP of Sales, this alloy is corrosion-resistant and has high elongation values. Fehrmann’s portfolio for additive manufacturing also includes the special alloy AlZnty5, as well as various standard materials that range from tool steel and AlSi10Mg to titanium and copper alloys. While the company has its internally produced alloys atomized via a qualified partner network, the standard materials are sourced internationally.

FURTHER INFORMATION:

Tags

- Materials

- Additive Manufacturing

- Medical technology

- Market reports and studies