Text: Thomas Masuch, 3 September 2024

Applications in medicine and dentistry are a constant driver of growth in additive manufacturing. Join us for an overview of the development of specific sectors and the market at large.

The fact that medicine was one of the first fields in which additive manufacturing was used was no coincidence. It’s an area where AM can all of its strengths to bear: Whether it’s implants, crowns, or surgical guides, the products in question are often complex and tailored to the individual patient. It’s also no wonder that medicine not only remains one of the key markets in AM today, but looks poised for healthy growth going forward, as well. Every year, the technology takes hold in further areas of application, and more and more hospitals are establishing their own AM departments.

One of the global leaders in 3D printing of this kind is surely the Mayo Clinic (Minnesota, USA). In Germany, meanwhile, Münster University Hospital has built its own impressive 3D center and amassed a great deal of related expertise over the past two years. It describes this facility as the “first institution in the world that meets the strict requirements of the ISO/ASTM 52920 standard and is licensed to manufacture and administer medical products at the point of care” (to find out more, please turn to the report on the University Hospital Münster.

Healthy market growth: from new approvals to more affordable systems

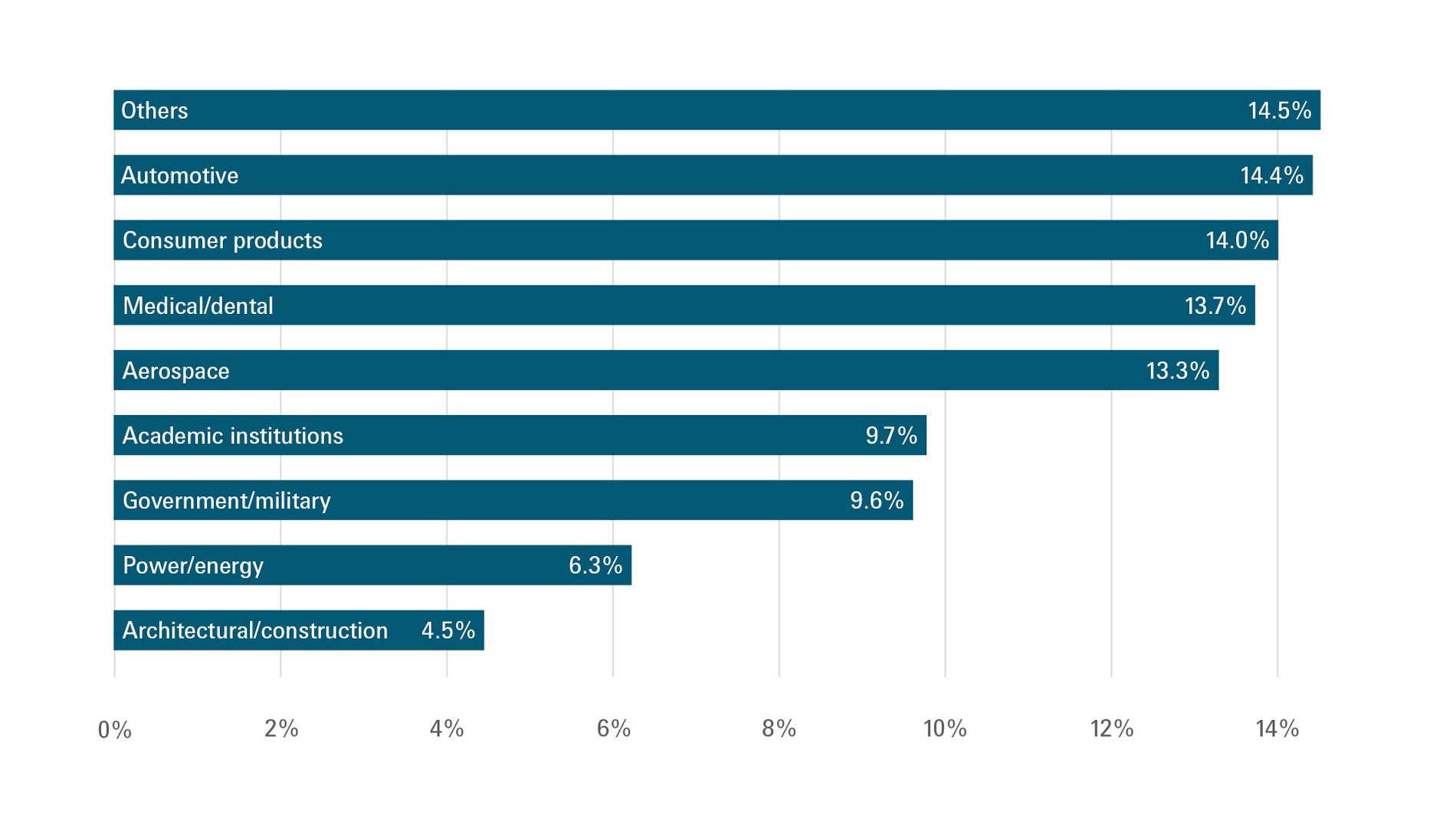

According to the most recent Wohlers Report, medical and dental applications accounted for US$2.75 billion last year, which represents 13.7% of the overall AM market. Terry Wohlers (head of advisory services and market intelligence at Wohlers Associates) expects such applications to continue evolving on various fronts in the coming years – particularly in connection with clear polymer aligners, polymer models for dental treatment planning, and crowns and bridges.

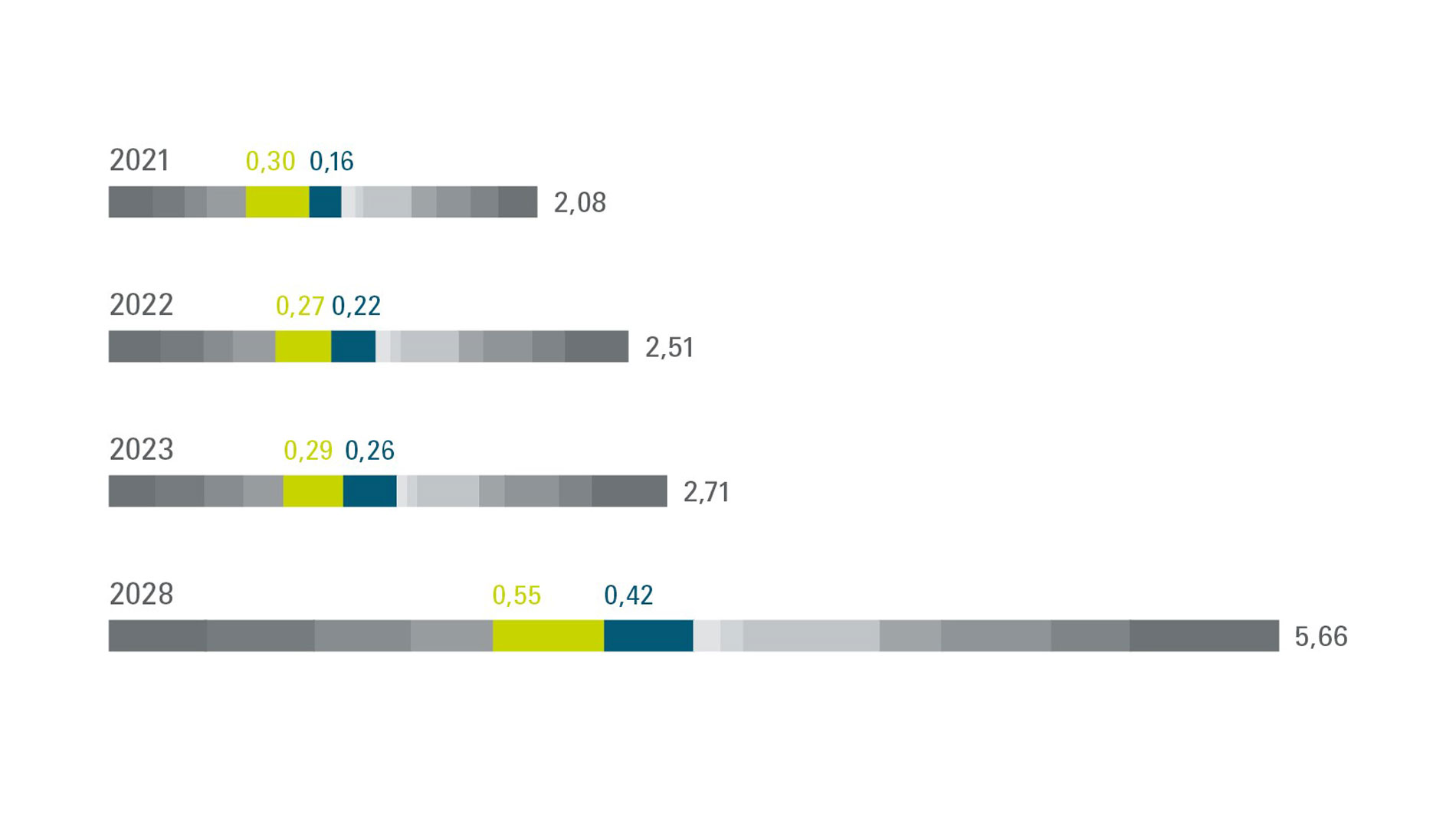

The market share of equipment used solely for production purposes is even larger: The Ampower Report has assessed it at 20.3%, which corresponds to an overall volume of €500 million. That’s nearly twice as much as the next most prominent sector in industrial applications. Even when considered separately, medicine (10.7%) and dentistry (9.6%) perform admirably.[1] For the years ahead, the market researchers at Ampower are projecting a constant increase in machine sales, which could reach €970 million in total by 2028. “After one or two down years when the COVID-19 pandemic suppressed demand and there was uncertainty regarding the approval of new products, the market is back on an upward trajectory,” reports Ampower CEO Maximilian Munsch. “We’re also predicting that the pioneers in the medical field will gradually replace their old machines.”

Meanwhile, the company’s analysis indicates that the dental sector will grow somewhat more slowly than the rest of the market. Ampower’s projections put the dental market’s share of total sales in AM machines at 7.4% (€420 million) in 2028. “Dental is an established market, so it’s already reached a certain amount of saturation,” Munsch explains. “In metal printing, low-cost systems are available that generate less revenue.”

[1] The 2024 Ampower Report estimates the volume of the current overall market for production equipment in metals and synthetics at €2.71 billion.

Considerably more optimistic regarding the development of the dental sector are the analysts at Vantage Market Research, who expect the corresponding global market in 3D printing to grow to US$14.6 billion by 2032. Just how reliable this forecast is meant to be is difficult to determine, however.

New materials and applications in medical implants

Outside of dentistry, implants represent some of the most important additive applications in medicine, as well. Metal 3D printers are churning out hip and shoulder joints by the thousands, along with corresponding surgical instruments. These implants offer several advantages over their conventional counterparts: 3D-printed joints can be customized to each individual patient, for example, and their porous surfaces promote faster and more stable bone ingrowth.

This is another area where 3D printing continues to gain users in further areas of application. In fact, the US company ZSFab just recently announced the first clinical use of a 3D-printed titanium implant in a patient’s lumbar spine. Dubbed the InterConnect 3D Printed TI Lumbar Interbody System, the implant has featured in three spinal operations at Tulsa Spine & Specialty Hospital in Oklahoma. The combination of a special surface and a stochastic lattice structure was also used in order to enhance the osseointegration process.

The field of material research has also been making major progress of late, which is why implants no longer need to be made of metal alone. 3D Systems, for example, unveiled 3D-printed cranial implants made of plastic at Formnext 2023. Since then, the US firm has reported that its 3D-printed PEEK implants have been used successfully in nearly 40 cranioplasties all across Europe in recent months, including at University Hospital Basel (Switzerland), University Hospital Salzburg (Austria), and the Tel Aviv Sourasky Medical Center (Israel).

3D Systems says the implants could be used in connection with other indications in the field of orthopedic surgery, as well. This past April, it also announced that its 3D-printed, patient-matched VSP PEEK Cranial Implant had been approved by the FDA. This approval covers the entire surrounding workflow, which includes segmentation and 3D-modeling software, 3D Systems’ own EXT 220 MED printer, and Evonik VESTAKEEP i4 3DF PEEK (polyether ether ketone).

The company believes that its PEEK implants have a great deal of potential in the market for cranial reconstructions, which it predicts will grow past the US$2 billion mark in 2030. According to 3D Systems, this technology requires up to 85 percent less material, which makes it highly cost-efficient. “3D-printed cranial plates made of PEEK are an innovative solution that can improve patient care and open up new possibilities in precise, patient-specific neurosurgery,” affirms Dr. Johannes Pöppe, chief physician in the neurosurgery department at University Hospital Salzburg. “It’s revolutionizing our field, and I believe that customized PEEK plates have a lot of potential when it comes to integrating 3D printing into everyday clinical practices.”

More standards and tailored treatments in the future

Terry Wohlers is also predicting a significant increase in orthopedic implants in the coming years, especially with regard to standard components for spinal and hip prostheses. “Patient-specific treatments will become more common as well, but are likely to remain the exception rather than the rule,” he states. In addition, Wohlers projects a rise in the use of AM for individual incisions in full knee replacements and in custom-3D-printed implants for cranial and jaw reconstructions.

Documenting the advantages of preoperative planning

Physicians at more and more hospitals are using 3D-printed models to prepare for surgeries. Among other benefits, such efforts are meant to reduce the duration of operations and help patients understand their impending procedures. A clinical study by Stratasys and Ricoh USA is now attempting to determine how significant the advantages of these models actually are. In the process, it is examining the use of individual 3D-printed models for preoperative planning and tumor removal in orthopedic oncology and comparing it against the current standard method, which is based solely on CT or MRI scans.

The study aims to identify potential improvements in surgical outcomes, such as reduced blood loss, shorter operations, and lower risk of complications. In an experimental group, tumors are being removed with the help of 3D-printed models, while a control group is working with the aforementioned imaging techniques.

Recognizing prostheses and orthoses as a business opportunity

Orthopedics is another field where additive manufacturing is playing an increasingly prominent role (for a more detailed analysis, check out the 02/2024 issue of FON). The common applications include customized orthoses for hands and forearms. According to Wohlers, however, predicting the further development of this area is no easy feat. “It’s hard to say how this field is going to evolve in the future,” he admits. “Like with other medical applications, professionals in this area are going to have to start seeing AM as a chance to establish new lines of business.”

Those who have already recognized a new business opportunity in this sector include Create it REAL (Denmark) and Ortóiberica (Spain), which specializes in orthopedics. The two companies are planning to enter into a strategic partnership in order to bring 3D-printing technologies for seating aids and corrective corsets to market. Ortóiberica will be responsible for Spain, Portugal, and Morocco. Create it REAL, meanwhile – which previously specialized primarily in insoles, as we reported in our 03/2023 issue – is also looking to expand its reach in the orthopedic sector and contributing its fully digital CAD-CAM solution for that purpose. Toward the end of this summer, Ortóiberica is set to start producing 3D-printed corsets, seats, and cushions at its facilities in Asturias, Spain.

Dental aligners driving growth

In the dental market, 3D-printed crowns, bridges, and implants have been widely used for some time, even replacing previous manufacturing methods in some cases. Further progress has also been made in other areas, including in the use of new materials like ceramics. At Kepler University Hospital in Linz (Austria), for example, a ceramic implant 3D-printed by Lithoz was recently inserted under the periosteum of a patient’s jaw. According to Lithoz, this novel approach is designed to eliminate the need for bone augmentation and reduce the time required for healing by an estimated 75 percent. The implant in question, which was made of biocompatible zirconia, proved to be clinically stable 60 days after the operation, which meant the adjustment of the patient’s dental prosthesis could begin.

Elsewhere in the dental sector, aligners have been turning in tremendous growth in the past several years, and market analysts believe that trend is set to continue. In just one example, 3D Systems recently announced a multi-year deal worth around a quarter of a billion dollars that involves the indirect manufacture of aligners. The company claims that its 3D-printing systems can produce up to a million aligners in a single day.

Another landmark development in the aligner market was surely the €79 million acquisition of the Austrian start-up Cubicure by Align Technology, a medical equipment firm based in Las Vegas (USA). Cubicure has developed patented hot lithography technology that makes it possible to process highly viscous resins and thereby produce extremely durable, temperature-resistant polymers.

Meanwhile, Fidentis – a spin-off of Fraunhofer IGCV – is seeking to improve many people’s lives with 3D-printed removable dentures. To that end, its young project team has received €1.46 million in funding as part of the EXIST Transfer of Research directive, which was initiated by the German Federal Ministry for Economic Affairs and Climate Action and the European Union. Fidentis reports that at present, few people can afford high-quality telescopic dentures. With the help of AM and a variety of digitalization solutions, the company wants to make them accessible to a wider range of patients.

Fidentis is working with an M 290-1 1kW 3D-printing system that was customized by AMCM to include an integrated robotic arm, which makes multi-material applications possible.

A long road to widespread use in manufacturing pills

The 3D-printing of pills actually isn’t anything new; the FDA granted corresponding approval for the first time back in 2015, to the epilepsy drug Spritam. Since then, however, this field has advanced much more slowly than most experts predicted. AM has not succeeded in truly breaking through in competition with the established and endlessly proven practice of pressing active and auxiliary ingredients into pill form. One reason why surely has to do with the complicated approval processes in this highly regulated market.

Just recently, however, some momentum has found its way back into this area, with major corporations like Merck intensifying their efforts to 3D-print medicine. The potential advantages of printed pills relate to both the development and approval of new medicines and the treatment of individual patients. “3D printing makes us much more flexible in the early stages of medicinal development and enables us to individually control the form, size, dosage, active ingredient release, and other characteristics of a pill simply by making a few changes in a digital file,” explains Thomas Kipping, head of drug carriers at Merck.

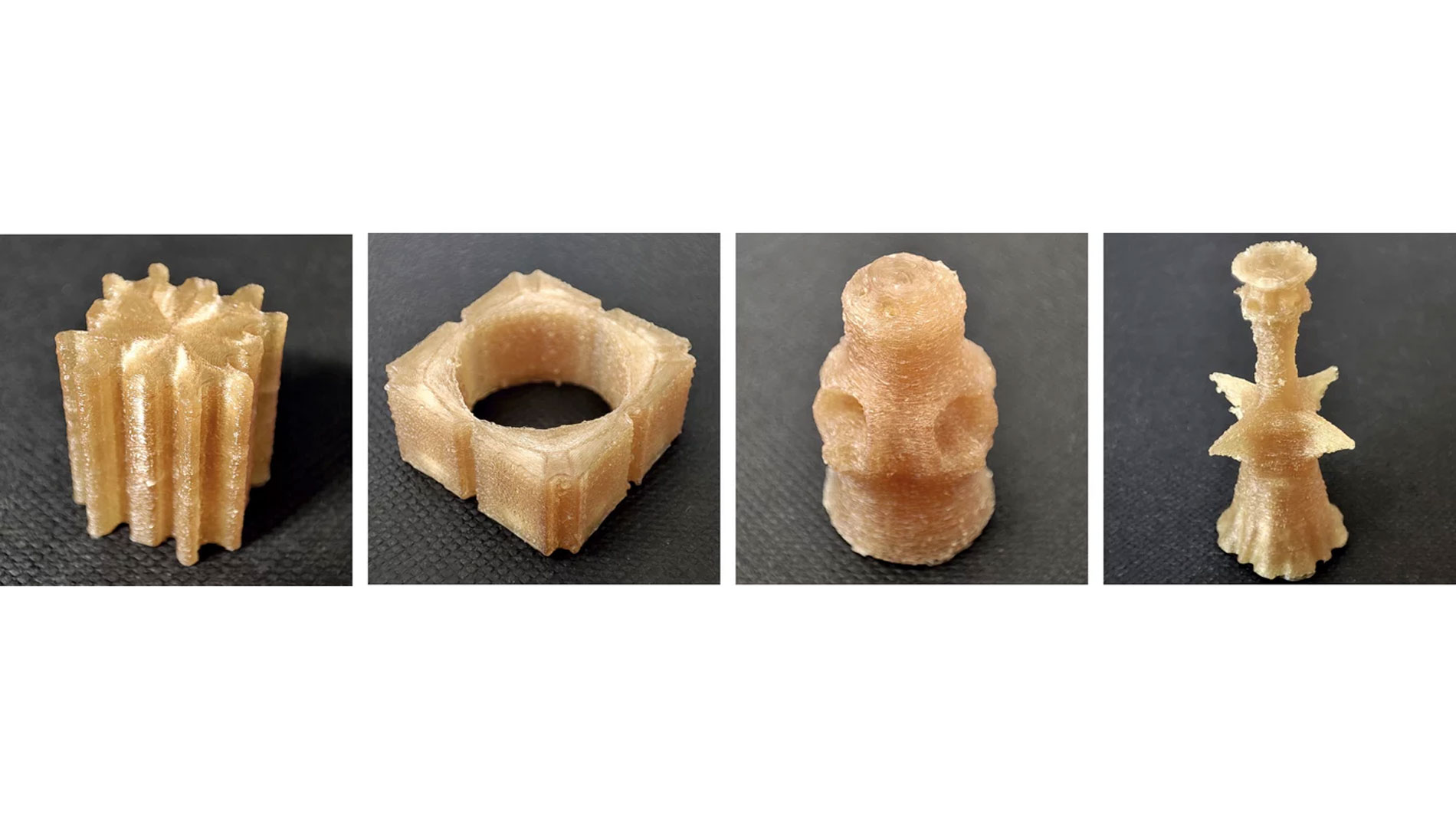

The Exentis Group also wants to make the 3D printing of pills a more established part of its operations. The Swiss organization – which was founded in 2017 and now employs 130 people – has thus developed a platform that combines screen and 3D printing. “With our proprietary 3D technology platform, we can manufacture pills with individual designs and active ingredient combinations in quantities of more than 200 million per year – all in the same production system,” reveals CEO Gereon Heinemann. In Exentis’s cold printing process, a medicinal paste is pressed through screens by a doctor blade, thereby producing millions of pills layer by layer. This fully automated procedure makes it possible to combine up to three active ingredients in the same pill. The key advantage over conventional pills lies in the ability to specify how active ingredients should be released in the body over a period of up to 12 hours. This is achieved by printing these ingredients in different shapes. The effect such designs have on active ingredient release was the subject of research conducted by a group of experts from the Max Planck Institute for Informatics (Saarbrücken, Germany) and the University of California-Davis (USA) in 2023. In addition to pharmaceutical ingredients, Exentis’s 3D technology platform is capable of working with biomaterials.

Future potential in skin and organs

3D printing can indeed be helpful when researching and developing new medical possibilities – and that applies to applications involving the tiniest components, as well. Take Boston Micro Fabrication (BMF), for instance, which has founded the subsidiary BMF Biotechnology, Inc. to work on the development of high-precision, microfluidic 3D biochips for pharmaceutical and cosmetic research. These “organ-on-a-chip” platforms make it possible to reproduce physiologically relevant tissue on a large scale, which is meant to improve the testing of cosmetics and medicines. BMF’s biochips feature an integrated “vascular” network of channels that facilitate a near-in-vivo exchange of nutrients and waste, as well as the delivery of substances throughout the tissue in question. This design enables them to produce more precise test results than conventional 2D cell cultures and animal models.

Generally speaking, the 3D printing of cells to produce living tissue is still in development and far behind the other applications, as Terry Wohlers explains. “Most of the work that’s been done so far has been R&D ranging between TRL 1 and 4, with few exceptions,” he reports. “This field will be significant one day, but it will be quite a few years down the road.”

FURTHER INFORMATION:

For more exciting insights regarding the use of AM in medical technology and healthcare, be sure to check out the Application Stage at Formnext from noon to 1:20 pm on 19 November 2024.

Tags

- Dental technology

- Medical technology

- Research and development