by Thomas Masuch - 03 November 2020

The Main Incubator discusses in a research paper the effects and opportunities of AM for the world of banking

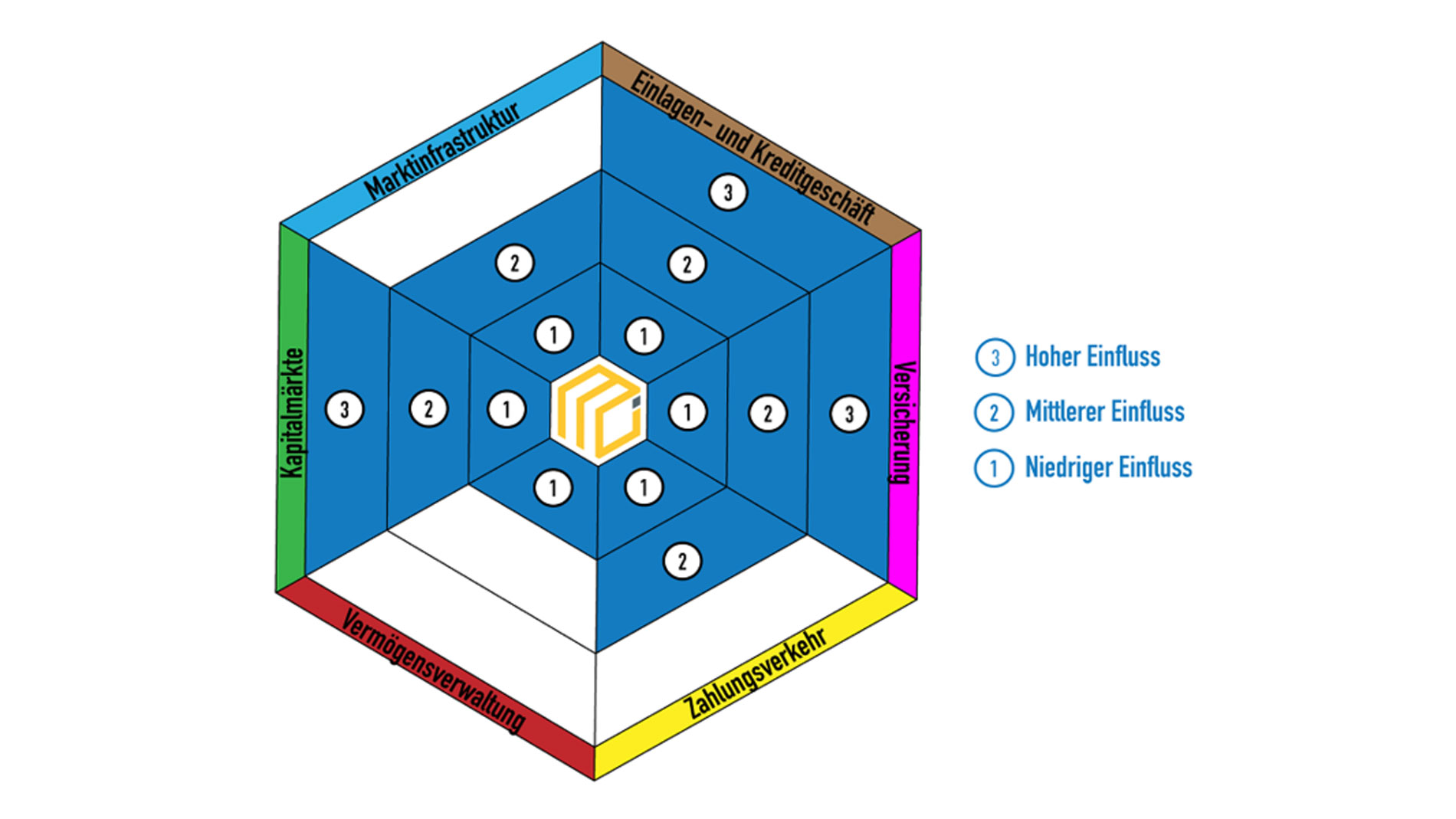

For several years, the financial world has been actively focused on Additive Manufacturing. In doing so, investments in start-ups, multi-million takeovers and IPOs have proved to be a worthwhile business. However, the fact that 3D Printing can mean a lot more for the financial sector is demonstrated by the research paper Printed Disruption: Additive Manufacturing and Financial Services, which has been produced by the Main Incubator, the R&D Department of the Commerzbank Group, in cooperation with ACAM (Aachen Centre for Additive Manufacturing) and the law firm SKW.

»The financial world and the world of manufacturing are both undergoing profound changes. It is for this reason that we have asked ourselves the question what effects these changes might have on a bank’s activities«, says Dirk Plewnia, technological expert at the Main Incubator and co-author of the research paper. Changes in supply chains may have effects on the assessment of risk or require new settlement models, for example, in the case of new business models such as shared factories. »After all, financing is not the only support a bank can provide«, explains Dr. Solveig Köbernick, Research Editor at the Main Incubator, who conceived and co-authored the paper. Other examples where the expertise of a financial institution can have a future impact are the fields of digital identities or secure data transfer, based on secure network technologies and Blockchain with IoT.

Digital identities and secure access rights

»It is particularly in Additive Manufacturing that digital identities and secure access rights will play an important role in the future«, according to Köbernick. It not only affects people and organisations but also machines that can network with each other, even enter into contracts and trigger payments. »With their expertise in data security, banks can play an important role here and be a reliable partner.« The Main Incubator has already developed a solution for this with the Lissi project for digital identity management, which in 2020 received the Handelsblatt Award for Digital Banking and was sponsored by the Federal Ministry of Economics and Technology.

A further application of new solutions from the banking world is conceivable where production is becoming increasingly transparent through digitalisation and Additive Manufacturing. »As the importance of sustainability continues to grow in overall production, at the same time it is becoming increasingly important to ensure there is a traceable audit trail for sustainability from the raw material to the product on the shelf«, says Plewnia. That is also something that is playing an increasingly important role for a bank as a financing partner.

In order to further expand such financial models around digital identities and settlements from Additive Manufacturing, Köbernick and Plewnia have already exchanged ideas with some manufacturers of AM plants. In future they intend to further intensify their contact with the industry »to jointly work out together how the AM world can be made safer and to jointly develop solutions to this problem.«

MAIN INCUBATOR:

The Main Incubator is based in Frankfurt and functions as the R&D unit of the Commerzbank Group. It undertakes research into economic and socially relevant future technologies, developing sustainable solutions for the financial services sector and industry. At the same time it is investing in tech start-ups with innovative banking solutions. By their own account, the subsidiary of Commerzbank AG with 20 employees is the only R&D department of a bank in Germany.

main-incubator.com/papers

lissi.id

Tags

- Additive Manufacturing