Text: Thomas Masuch, 21 May 2024

The gold-rush mentality that surrounded start-ups in years past has given way to a more somber mood among founders and investors. In fact, the valuation of such firms has practically fallen off a cliff as of late according to a study by Ampower and AM Ventures, who have analyzed the development of start-ups and investments over the past decade. Ampower founder and CEO Matthias Schmidt-Lehr believes that the corresponding consolidation points to conclusions that can be drawn for the AM market as a whole.

From his own projects and conversations with numerous investors, Schmidt-Lehr knows that valuations of start-ups are often based on the stock market valuations of established companies. “Share prices have declined significantly and money stopped being so cheaply available long ago, which is why start-up valuations have fallen considerably as well,” he explains.

“Second wave of AM hype”

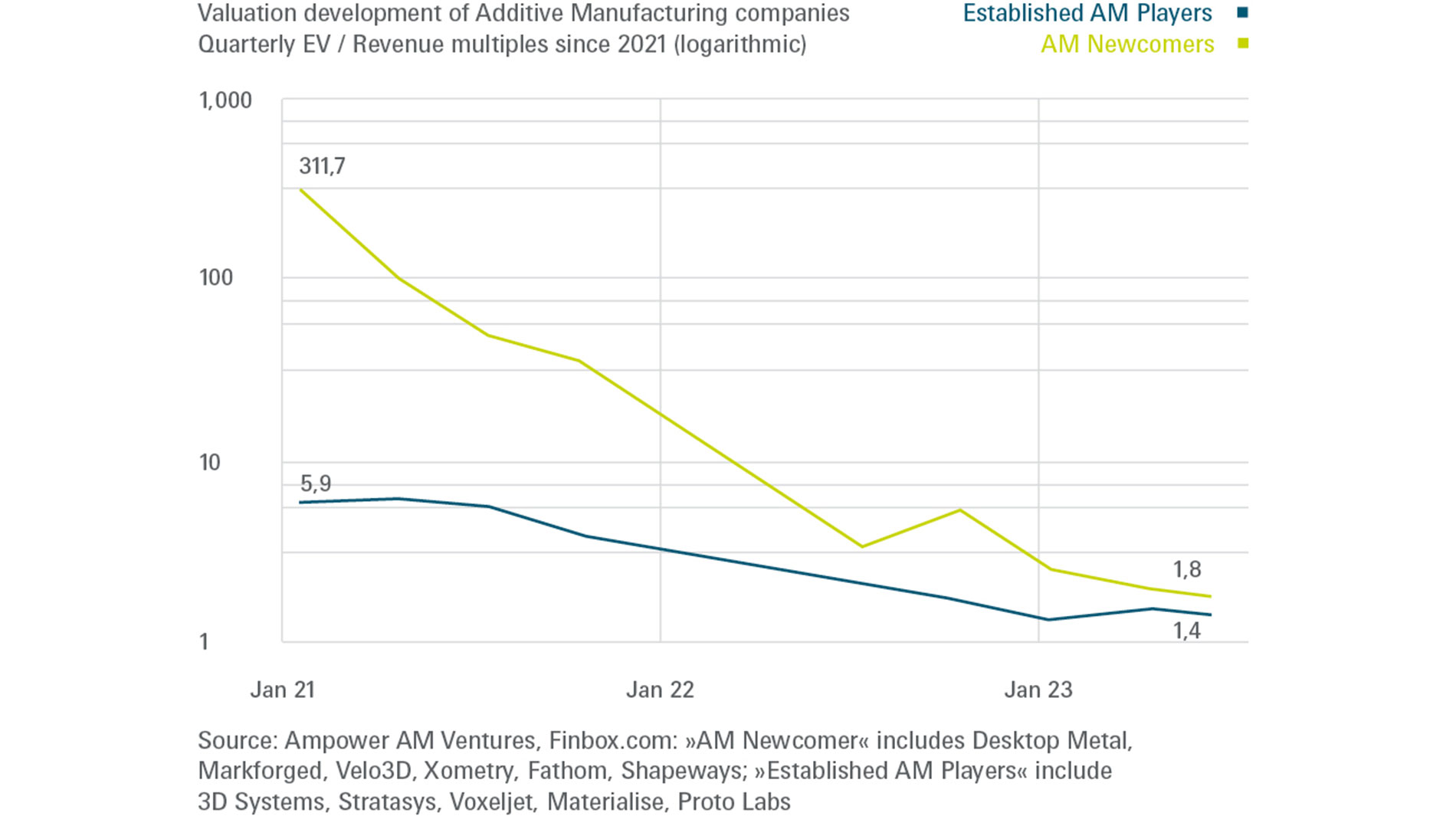

According to the recent study conducted by Ampower and AM Ventures, valuations of “AM newcomers” have plummeted from 311 times revenue to just 1.8 times revenue in the past two years. Valuations of established AM companies have also been on the decline since 2021 – from 5.9 times revenue to 1.4. Ampower sees one of the reasons for this trend in an “overestimation of the available market”. The firm also points out that in spite of the advancements made, additive technologies remain more expensive than traditional production methods in many areas, and the implementation of such innovations is often hardly trivial. Meanwhile, the “second wave of AM hype” has run up against an economic environment that has only gotten more difficult. That said, the wane in valuations hasn’t been limited to companies in AM; the same has been seen in connection with other growth technologies.

The high cost of rapid growth

For Schmidt-Lehr, the evolution of the VC market for start-ups in AM portends the consolidation of the entire surrounding industry. “A number of things are going to change for young companies, especially if there’s no longer so much cheap money available,” he predicts, citing sales and marketing as an example. “Lots of AM companies are spending a lot on this area right now – 20 to 30 percent of their turnover in many cases.” In the past, there was a good reason to do so: It was the only way firms could meet the lofty expectations they faced with respect to their rapid global growth. As another driver of high sales expenditures, Schmidt-Lehr points to the fact that AM systems frequently require a great deal of explanation. “With large industrial systems, it often takes a year to turn a lead into an actual sale.” Particularly in comparison with other branches of industry (such as CNC machining), the difference is dramatic. “In those areas, customers are usually familiar with the technology and know what they’re getting. That makes the process of selling systems much simpler and more efficient,” Schmidt-Lehr says.

Focusing on specific applications

At the same time, Ampower’s CEO thinks consolidation offers many benefits, as well. “It will help the whole industry if we can let some air out of the bubble and get on the path to healthy growth,” Schmidt-Lehr declares. He’s already seeing corresponding signs: “Even really promising start-ups are being a bit more modest about how they present themselves and focusing on specific applications. The times when AM companies claimed they were going to revolutionize production are over.” That’s why Schmidt-Lehr advises start-ups to zero in on clear-cut use cases and learn as much as they can about the needs of their respective target groups.

The engineer and industry analyst in him also foresees a “future in which there are going to be more mergers of AM companies that offer similar products”. As for whether this will result in fewer new technologies finding their way to the market, Schmidt-Lehr says it’s difficult to say at present. After all, for example, universities continue to conduct a large number of new research projects. “Ultimately, though, it’s definitely going to be harder for company founders that want to establish new technologies,” he explains, alluding to both the increased cost of borrowing money and to how mature the AM market has become. “There’s less potential for radical improvements all the time,” Schmidt-Lehr adds. “And when you have 40 different technological approaches, the niches in which many companies do business get smaller.”

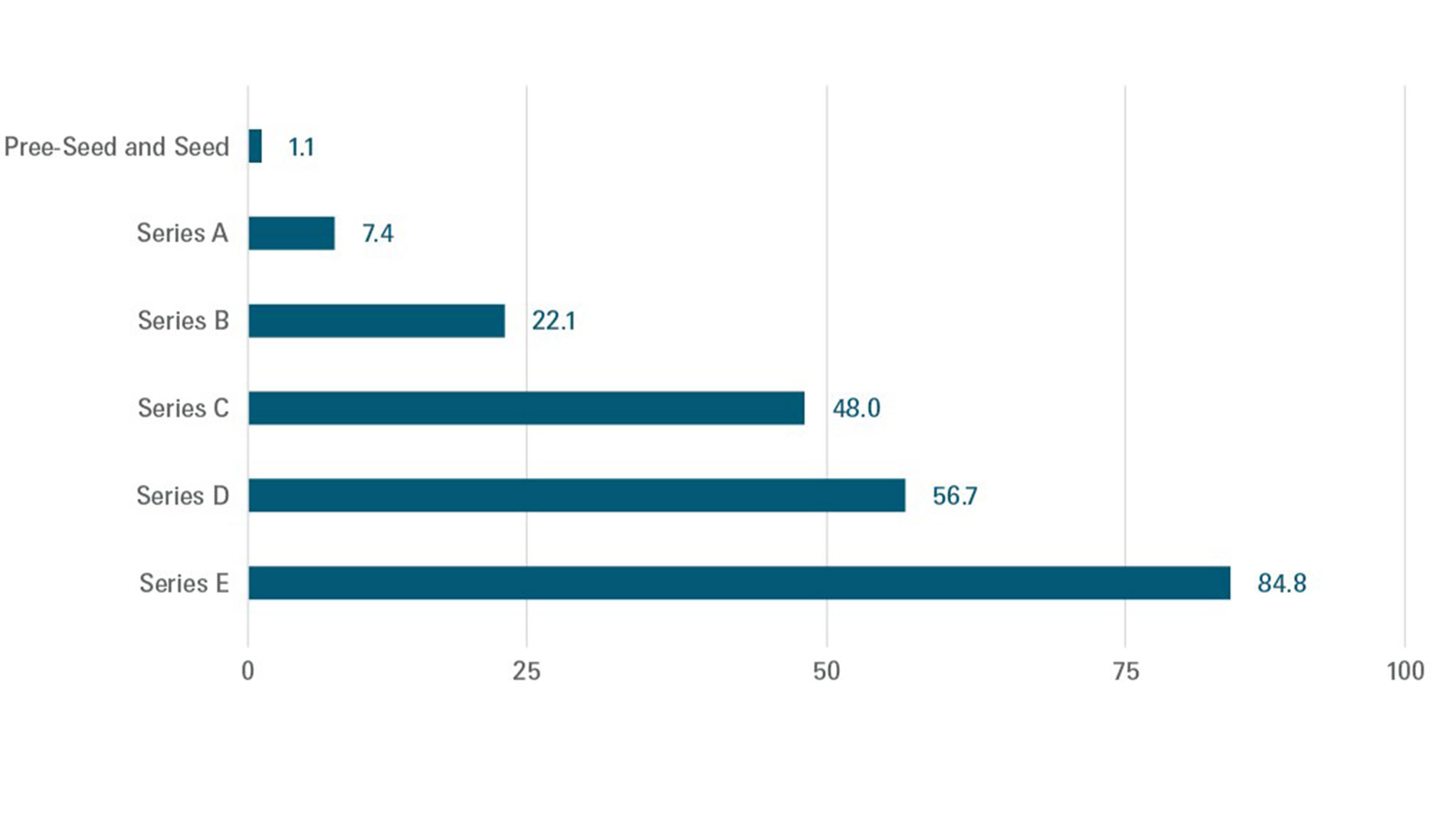

Average financing volumes for AM technology startups over the past 10 years in EUR million. Source: Ampower

FURTHER INFORMATION:

Tags

- Market reports and studies