Text: Thomas Masuch, 18 December 2024

There was such a wealth of innovations and applications on display at Formnext 2024 that not even two articles could cover them all. After highlighting current trends (including some related to the industry’s development in recent years) in our first installment, the second part of our review looks at the areas in which new applications are emerging, the challenges AM system manufacturers are facing, and why the market continues to grow despite some larger companies’ complaints of a decline or stagnation in sales.

Takeaway 5: “Niches to be taken seriously” – breadth of applications continues to grow

A tour of Formnext provided a very clear answer as to why the AM sector continues to grow, even though many a large company has recently reported a drop in sales. Across all four exhibition halls – including at many smaller booths – exciting use cases from an increasing number of application areas beyond medical and aerospace were on display, including from electronics, energy (such as 3D-printed pipelines), or the footwear and clothing sector (Carbon, Stratasys, and others). Areas of application that previously had a rather experimental character are now delivering real-world business stories. Even if this does not immediately change the dynamics of the entire industry, Andreas Langfeld, president of EMEA & APAC at Stratasys, now sees a “niche to be taken seriously” in the fashion sector, as he explained in an interview with Formnext Magazine (detailed report to follow).

The same applies to the construction and architecture sector, where innovations for future applications were presented at the BeAM special showcase (including structural components, furniture, and sustainably printed elements). Specific applications and business opportunities could also be found at the booths of some exhibitors, such as 3D-printed busts or works of art made from stone dust (Concr3de) or animated models for urban and traffic planning (Team Kubitur at the IGO3D booth).

The 3D printing of ceramics is also enabling more and more applications, as was evident in the rather prominent presences of 3DCeram, Bosch Advanced Ceramics, D3, Lithoz and others. Meanwhile, user industries that were previously less well-represented are discovering the diverse potential of ceramic 3D printing, including in semiconductor production, the adhesives industry, or the raw materials sector (where Lithoz presented a filter system for lithium extraction). Such examples underline the future prospects of AM: Once new technologies are on the market and have reached a certain level of maturity, the drive of human creativity almost single-handedly ensures that new applications will continue to emerge, which ultimately results in market growth.

Takeaway 6: Higher productivity, lower costs

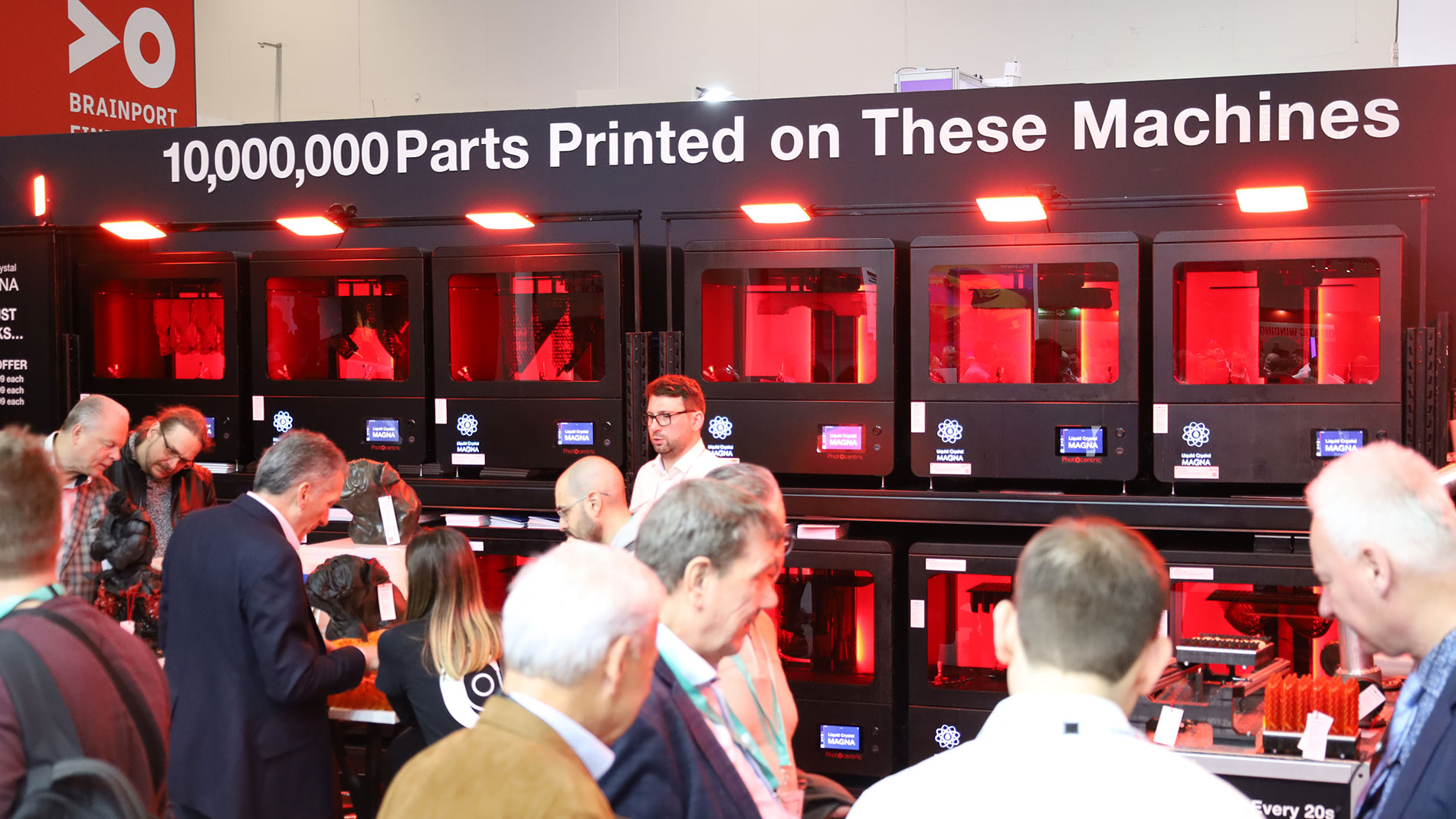

The demand for lower production costs has accompanied additive manufacturing since the very beginning, and Formnext 2024 was naturally also about 3D-printing components more cost-effectively. In every exhibition hall and along the entire process chain, improvements based on very different approaches were on display (as we already reported in our Fon Expo edition): Manufacturers of large PBF systems presented more efficient machines or improved printing strategies, and there were also numerous innovations in materials and post-processing. Optimized software solutions that speed up the design process or reduce rejects, for example, were also an important driver – one that has become virtually indispensable thanks to the significant sums it can ultimately save, especially for large and expensive components.

Meanwhile, low-cost desktop printers have become a real engine of productivity in the industry. Some offerings from Prusa, Bambu Lab, and others are so inexpensive that they are not even included in some market reports. With the right materials and expertise, however, they can sometimes meet industrial requirements. This certainly increases the pressure on established manufacturers, but also lowers the barrier of entry to AM for many companies and individuals.

Takeaway 7: Stronger competition from the Far East

When it comes to cutting costs, you also have to take a look at the Chinese exhibitors, of course. That’s why BLT was one of the most interesting booths I visited at Formnext 2024 – not necessarily because there were such exciting products on display (other companies had those, too), but because the new self-confident “Chinese spirit” was palpable there. Indeed, BLT has now developed into one of the largest AM companies in the world. True to its slogan, “Your Road to Serial Production”, it exhibited real solutions for mass production in AM, including a nozzle for a pressure cooker that BLT claims costs just U.S.$1.60 to 3D-print (instead of U.S.$2.50 in the traditional MiM process). “We produce 1.5 million of these per year,” reported a proud Gary Ding, managing director of BLT Europe GmbH.

Self-assured competitors from China have now secured a strong position in the AM market. Due to the highly competitive domestic market in the Far East, many Chinese AM companies are trying to offer their solutions internationally and have opened sales and service branches in Germany and other countries. Western suppliers are also feeling the pressure: During the press tour at Formnext, an executive from a large European manufacturer of AM systems admitted that they hardly sell anything on the Chinese market anymore because they basically have no chance against Chinese suppliers.

One bastion for Western manufacturers appears to be critical applications in growth sectors like aerospace and defense; according to market insiders, this is where skepticism about data protection and the security of intellectual property is greatest. Exceptions are also emerging, however: For example, BLT presented an O-ring seal at Formnext that is made from a specially developed alloy on BLT S-400 systems and used by Airbus in its A320 program.

Conclusion:

First of all, the entire market – and users in particular – love to see technology become cheaper; it’s the fastest way to make new applications possible, after all. In addition to the Chinese OEMs and the Chinese market (which has become much less dependent on Western technology), this benefits users, service providers, and contract manufacturers in the West. For Western suppliers of PBF systems such as Trumpf EOS, Renishaw, and Colibirum, the competition is getting tougher in some cases.

At the same time, many conversations have made it clear that plenty of users still have a certain amount of mistrust when it comes to data security in relation to AM technology from China. Recent allegations of plagiarism against a Chinese software provider have certainly not diminished these concerns.

In the coming years, it will be crucial that Western suppliers succeed in defending their strong competitive position by remaining innovative leaders and combining their higher machine prices with real added value. Europe and the USA need strong innovative suppliers of AM systems, materials, and software. Even if AM does not (yet) play a major role in the economy as a whole, the technology is hugely important in driving innovation in many user industries.

FURTHER INFORMATION:

Takeaway 1: Robustness of the industry

Takeaway 2: The importance of Formnext for the world of AM

Takeaway 3: Positive mindset in challenging times

Takeaway 4: The importance of user industries is shifting

Tags

- Market reports and studies