Text: Thomas Masuch, 15 February 2024

The AM sector in Eastern Europe is booming thanks in part to a dynamic economic environment

Poland is probably the leading Eastern European country in the field of additive manufacturing. Not only do numerous innovative start-ups and renowned companies such as Sinterit and Zortrax come from here; a total of 15 exhibitors from Poland were represented at Formnext 2023, including Progresja New Materials, a winner of the Formnext Start-up Challenge. In addition, international AM service providers such as Align Technology have set up production facilities in the country.

The Czech Republic has also developed successfully as an AM location. In addition to Prusa, it is home to numerous material manufacturers. At the same time, 3D printing is playing an increasingly important role in countries such as Hungary, Romania, Bulgaria, and Greece. In Romania, for example, additive manufacturing is taught at universities (including in Brasov, Bucharest, and Cluj), and high-performance service providers such as NUT Technologies and CAD Works have also established themselves here.

In the countries of southeastern Europe, additive manufacturing is “in a phase of dynamic growth,” explains Costas Andronikidis, who has a very good overview of the region as general manager of the Greek AM distributor Anima. “Even though 3D printing in these countries has not yet reached the same stage as in Western Europe, the upward trend in the implementation and use of AM is significant and the number of applications is steadily increasing.”

Exhaust manifolds and bone files

According to Andronikidis, small and medium-sized enterprises (SMEs) are the main drivers of this development. The key sectors include the automotive, aerospace, healthcare, and consumer goods industries. In the automotive sector, companies (such as the Romanian software developer CryptoData and its MotoGP team) use 3D printing for prototyping and the production of finished parts. "Things like exhaust manifolds are 3D-printed from durable and heat-resistant materials, resulting in lighter, yet robust designs that can withstand the extreme temperatures and pressures in exhaust systems,” Andronikidis continues.

The benefits of AM are also being researched and leveraged in healthcare – for instance, to produce medical devices that are tailored to the individual needs of doctors and patients. “One notable example of this is a project in Greece where a special medical tool – a bone file – was 3D-printed,” Andronikidis reports. Due to its small size and complicated design (which included specific angulation for the notches), the bone file was very difficult to produce using conventional methods.

Ongoing growth of 20 to 30 percent

Andronikidis expects the AM market in Eastern Europe to continue its rapid growth. “We expect an annual growth rate of 20 to 30 percent over the next three to four years. And if there are further technological developments, which we expect, this rate could continue for up to 10 years.”

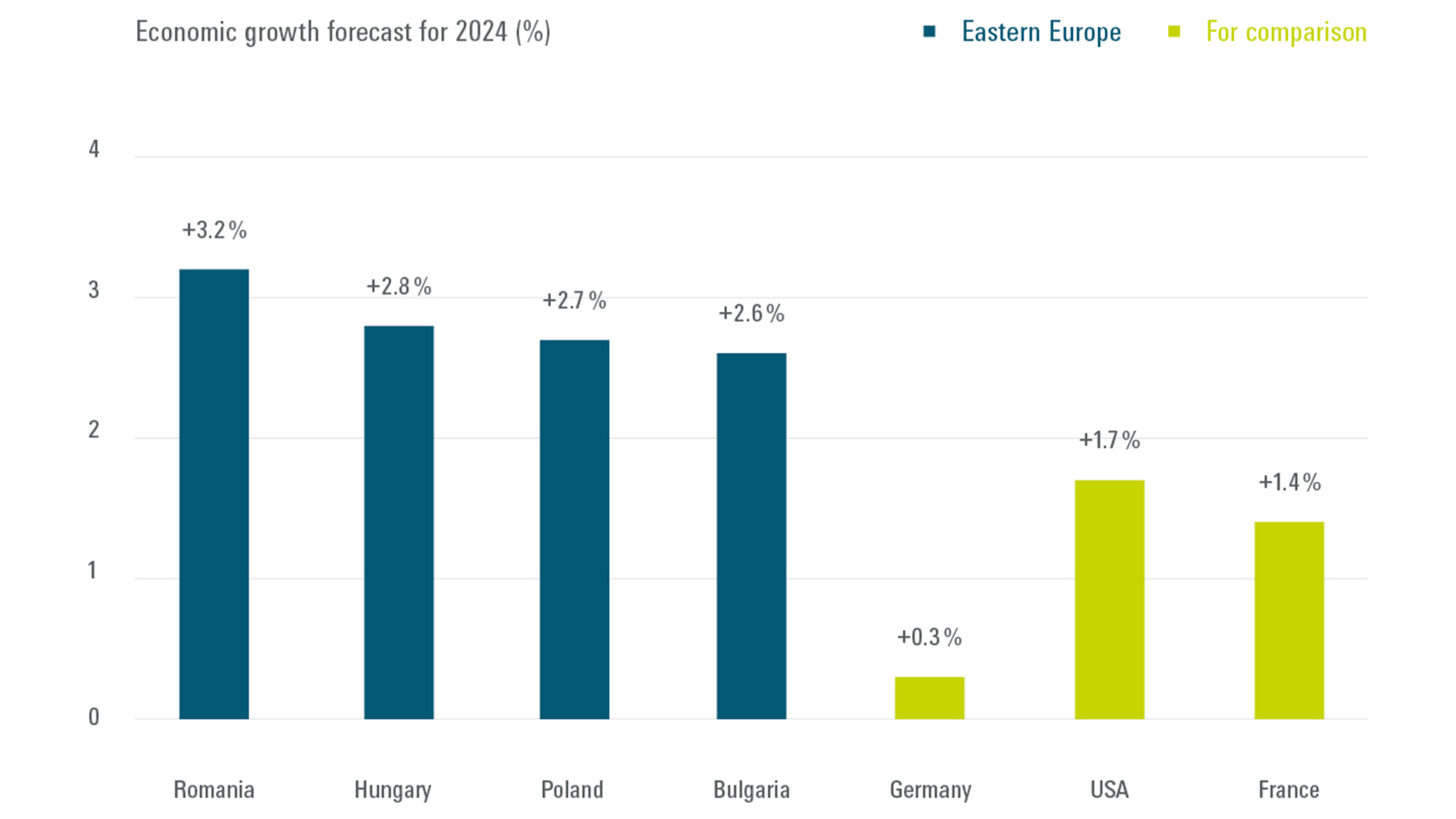

It bears mentioning that the development of the AM world in the region is benefiting from economic growth that is very solid in general, and much more dynamic than in most Western European countries. A rate of 3.2% is expected in Romania in 2024, followed by Hungary (2.8%), Poland (2.7%), and Bulgaria (2.6%). In comparison, expectations for Germany are significantly lower at 0.3%, while 1.7% is expected for the USA and 1.4% for France. (Sources: EBRD, BDI, US Federal Reserve, French Ministry of Finance)

Diversification of supply chains

Among other things, economic development is being driven by the efforts of Western European companies to diversify their supply chains (through nearshoring). Central and Eastern Europe are seen as reliable locations, which makes them preferred regions for companies looking for suppliers. Eastern Europe in particular makes compelling arguments thanks to its motivated workforce and low labor costs. In Bulgaria, an hour of labor costs less than €10 on average, whereas companies in Germany charge around four times as much. Business Park Sofia, which is more reminiscent of a modern industrial campus in the USA, is an example of the modernization in the region. International corporations such as Sony, HP, Unilever and KPMG have set up shop here.

FURTHER INFORMATION:

Tags

- Additive Manufacturing

- Market reports and studies