17 May 2023, by Thomas Masuch

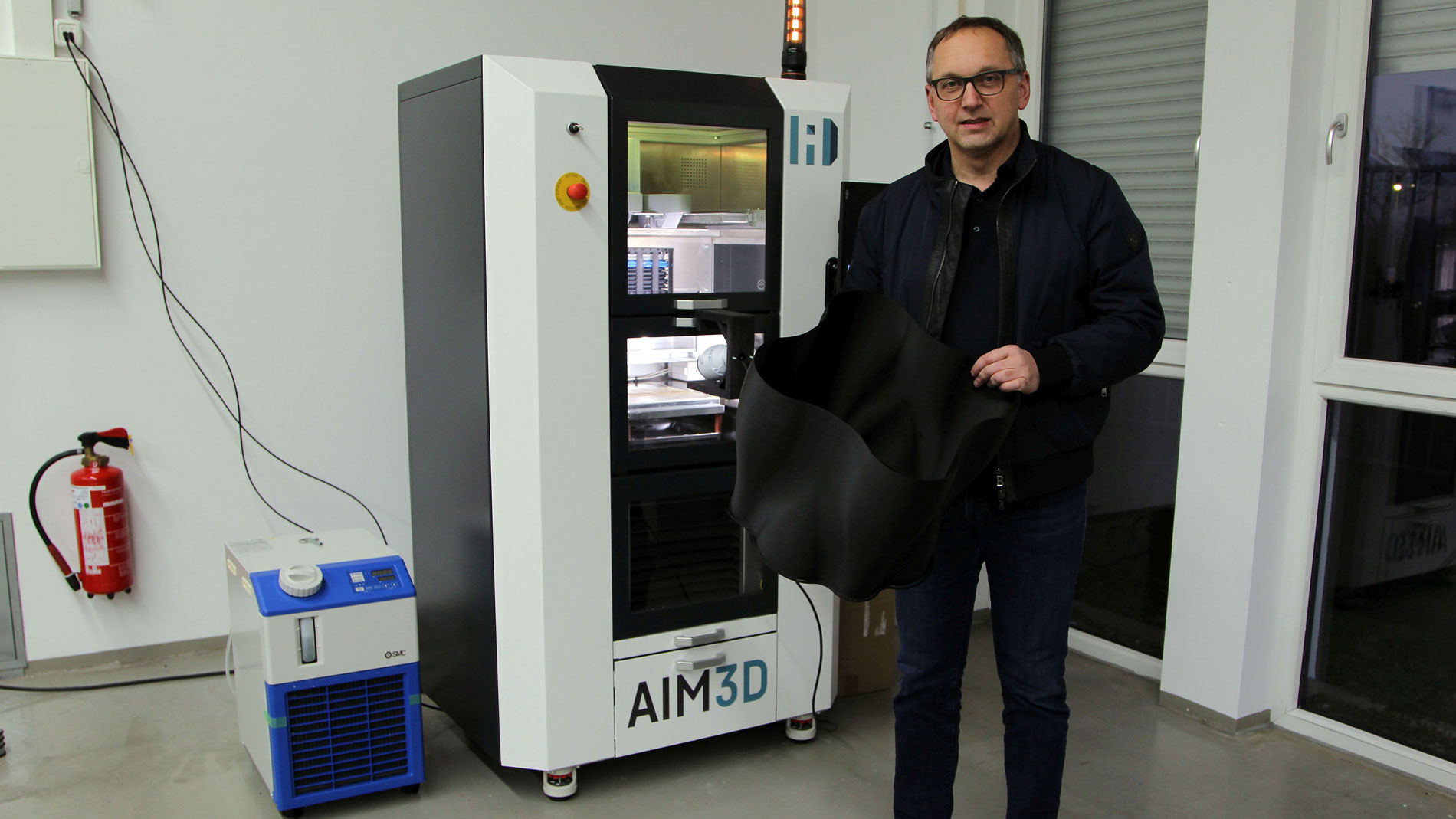

The interest rate increases instituted by the world’s central banks have redefined the rules of the game in the investment industry, as well. To talk about how much these changes are impacting the world of 3D printing and what lies ahead for AM start-ups and investors, we sat down with Frank Herzog, founder of Concept Laser and managing partner of the investment firm HZG Group.

Mr. Herzog, you look at hundreds of start-ups every year. The changing situation in the capital market has surely also had an effect on the financing of young companies in additive manufacturing, hasn’t it?

Right now, things are different than they were just a year or two ago. Then, it wasn’t rare for rounds of financing to involve hundreds of millions of euros, and I often found myself wondering when we’d see that kind of investment again. This situation has also led to a particular mindset among start-up entrepreneurs. In the past, some companies were valued in the tens of millions at very early stages despite there being no reliable technicals tools for arriving at numbers like those. That has changed dramatically: Lots of investors who used to throw money around are now acting with more caution.

If investment partners are now fewer and farther between, you must have fairly decent cards when it comes to negotiating with start-ups.

We are indeed in a better negotiating position these days, even though the HZG Group hasn’t been in the market for that long. Still, we’ve already noticed that start-ups were exuding a lot more confidence a year ago, as if to say, “If you don’t agree with our valuation, we’ll just get the money from someone else”. That’s another thing that has changed.

Perhaps that also has to do with the fact that outside of venture capital, start-ups don’t have a all that many ways to get infusions of fresh cash...

Yes, that’s true. It isn’t common for banks to grant loans to start-ups, especially in their early stages. What you’re left with then is venture debt – but the interest rates involved tie companies up for quite a few years. If you aren’t already growing, that’s a really difficult situation.

Along with the general financial circumstances at hand, Russia’s invasion of Ukraine and the subject of inflation continue to cause uncertainty.

And that really has an effect on start-ups. For many of them, it really is a matter of success or failure, and cutting costs isn’t enough; they have to take a good look at the purchases they make. At the same time, we’re investors in additive manufacturing, which is a market that’s still growing and still a target for investment. When you’re assessing the current economic situation, it’s not the same for every sector.

In other words, the economic situation in AM is different than in other areas of industry?

In additive manufacturing, we’re dealing with a special kind of market. The technologies in it are disruptive and playing an important role in the transformation of conventional industries. I come from northern Bavaria, for example, where the economy is dominated by the automobile industry. That kind of focus can also be dangerous. Plenty of suppliers are under pressure and thus continuing to invest in AM because it offers technologies that give them the chance to compete at the highest level.

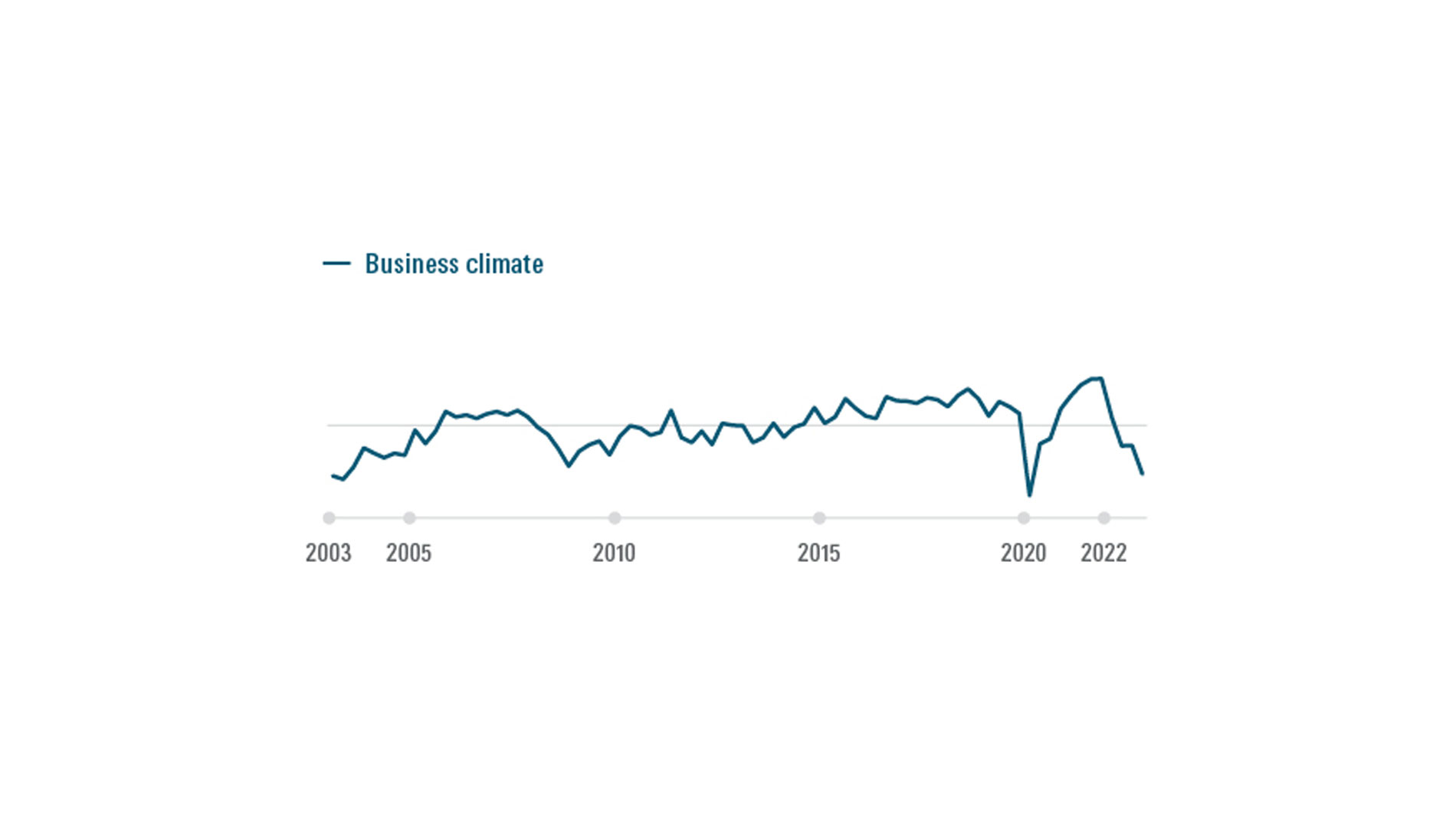

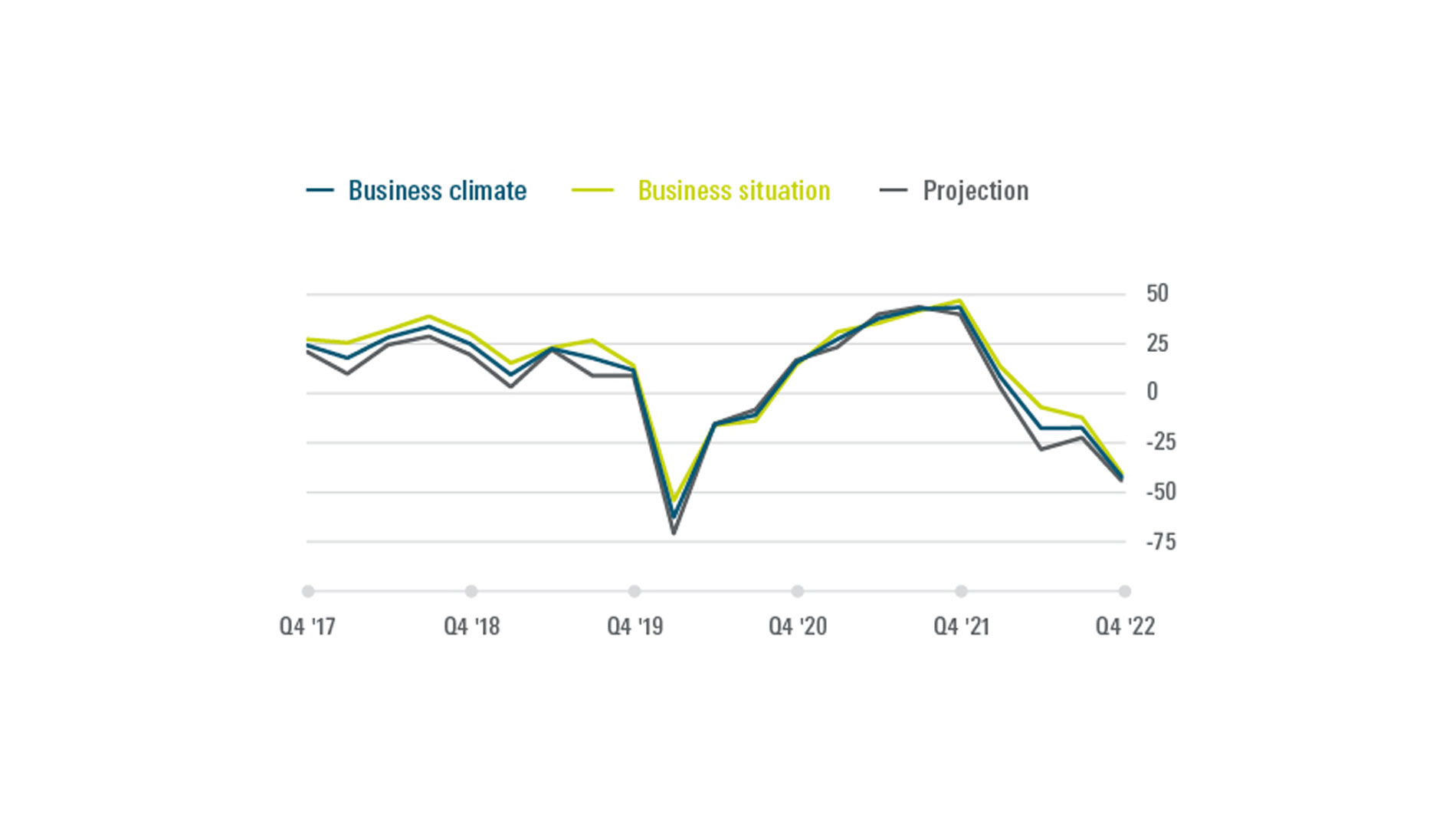

That sounds like an optimistic forecast for the AM market. Meanwhile, the German Venture Capital Barometer is now nearly as low as it was in early 2020 at the start of the Covid-19 pandemic (see graphic). The economic activity, interest level, and exit opportunities in the country all receive very negative scores. How have you and the HZG Group responded?

The financial climate has obviously also had repercussions for start-ups that deal with additive manufacturing. The times when tremendous growth was more or less taken for granted are over, at least for the moment. At the HZG Group, we have the luxury of being able to take our foot off the gas when necessary. After all, we already have a number of very exciting investments that we spend a great deal of effort looking after.

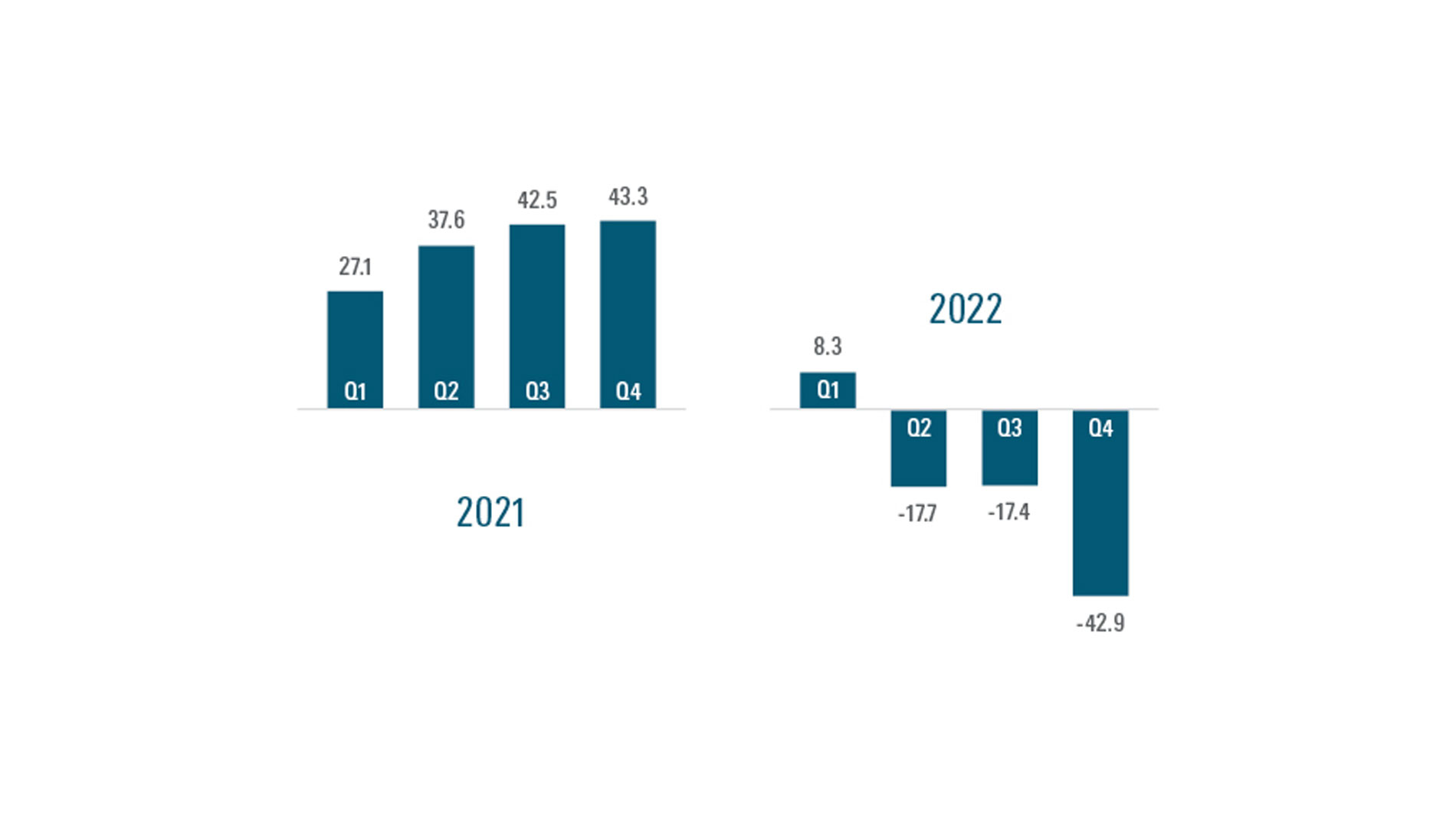

After the business climate in the venture capital sector was still very positive in 2021, it has turned around significantly in 2022. Even in a long-term comparison, the situation is currently very gloomy. Source: KfW Research, BVK, Deutsche Börse Venture Network

Does that mean you’re taking a more positive view of the current climate as an investor?

The main thing we’re benefiting from is our focus on long-term investment. We make conscious decisions to work with specific firms and accompany them during their ongoing development. The HZG Group offers an entire ecosystem that includes contacts in the realms of politics, research, and sales, along with our own R&D center, Naddcon. That makes us an effective catalyst for such advancement. These are factors that some start-ups don’t have at their disposal, even if they do have significant funding. What we provide is really resonating with the market because start-ups are often busy developing technology and don’t have a lot of time to spend worrying about sales or reaching out to potential users. That’s where we can help. It’s become quite clear that the support we offer has made us the first choice among start-ups, which means we end up dealing with the kind of companies we want to work with. This is a definite benefit for our fund investors, as well – we only make high-quality investments!

For many start-ups and investors, rapid growth used to be the main goal, even if achieving it took a considerable amount of capital. What advice do you give the companies you invest in these days?

We keep our feet firmly on the ground with our investments. Back when I founded Concept Laser, I had €750,000 in funding; the people investing were my relatives. It was a pretty modest budget to start out with. The four of us in the company presented our first prototypes at a trade show, and then it was about keeping our heads above water. It wasn’t easy, but we learned to be very conscientious in dealing with money. I definitely wouldn’t say that every start-up needs to go through the same ups and downs, but being really careful with invested funds is still important.

You have strong ties to the place where you grew up: When you sold your company to GE, you secured over €150 million in investment in a new location in the area; you’re the president of your local soccer club, and you invest mainly in the German-speaking countries. How does Germany stack up as a location for start-ups? The complaints about high taxes and energy prices – not to mention the bureaucratic red tape – certainly aren’t getting any quieter.

These are valid points and I can imagine them making foreign investors wary to some extent. But like you said, I kept Concept Laser in the place I came from, and we’ve worked with GE on investing €150 million in a modern 3D-printing campus in Lichtenfels – which involved selling the company for €100 million less. In the past few years, different entrepreneurs have poured another €100 million into 3D printing in and around the city. It’s worked out well. For years, though, it’s been aggravating to watch as hurdles keep popping up on the administrative side. It’s making it harder and harder to get things done. I’m not criticizing the officials themselves; it’s the political conditions that have been established. What we need is a measure that really cuts through that red tape and gets people’s attention abroad, as well. We won’t get anywhere resting on our laurels. That said, we do have an outstanding network in the areas of research, industry, and policy, and start-ups are among the beneficiaries. That’s why we’ll continue on the more difficult path with the public administrations if necessary. We just need to keep the lines of communication open.

Along with your connection to home, your commitment to the HZG Group has to do with your own personal motives. After selling Concept Laser to GE, you could have just kicked back and enjoyed life.

I guess it’s the idealist in me – which is something people often don’t buy, but it’s there. I’ve had a lot of success in business, and it’s definitely given me opportunities to effect change. I want to leverage these opportunities and the attention I get to benefit others in a socially minded way, in particular by enabling kids and teenagers to imagine their future in rural surroundings like ours. On top that, I’ve experienced the process of shaping a company from its foundation all the way to its integration into a major global corporation. We’ve put our capital into the next generation of additive manufacturing and continue to invest in up-and-coming technicians and engineers.

Mr. Herzog, thank you for taking the time to talk with us.

MORE INFORMATION:

Tags

- Additive Manufacturing

- Design and product development